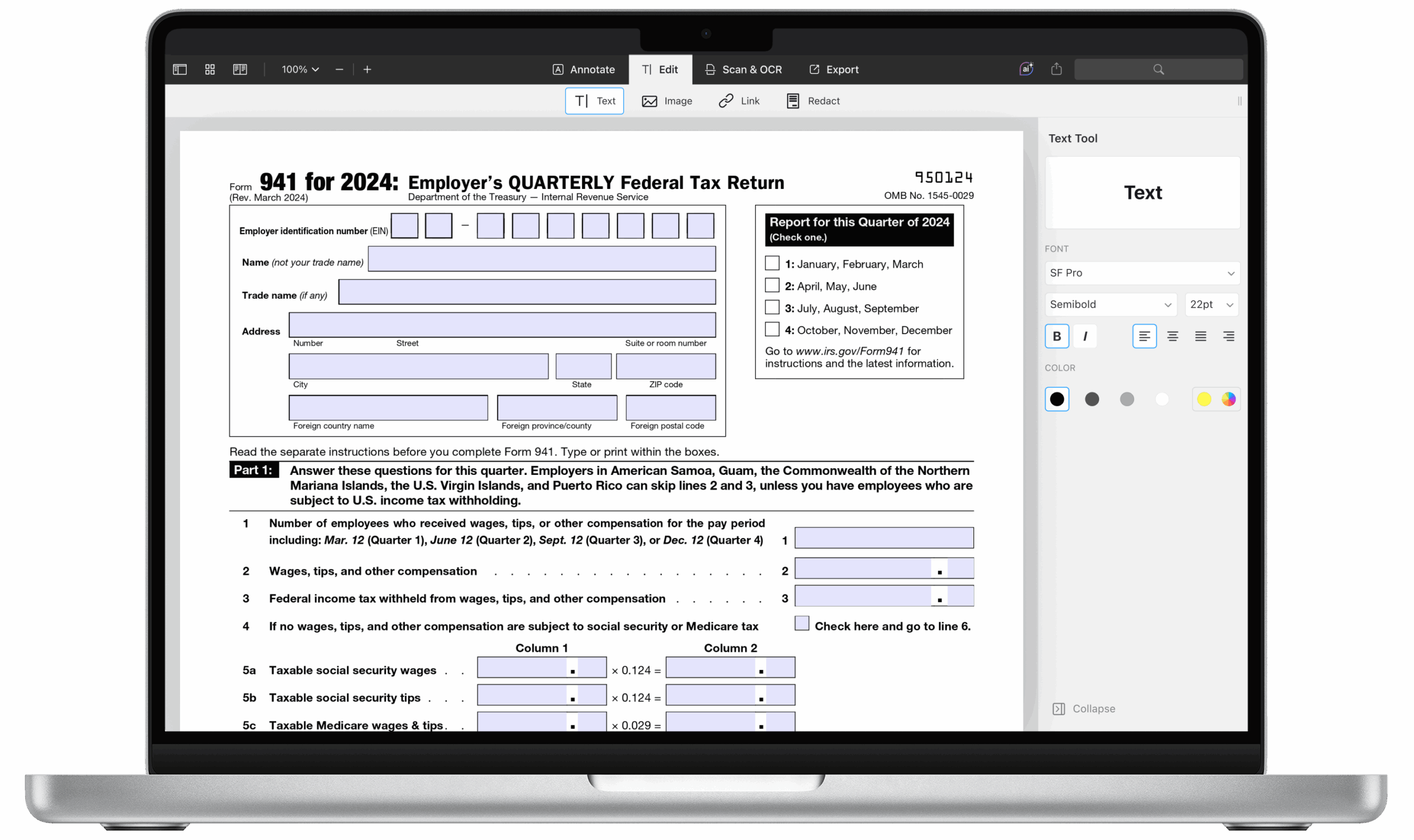

When it comes to tax forms, the IRS 941 Form 2024 is an important document for employers to file. This form is used to report quarterly wages, taxes withheld, and the number of employees for federal payroll taxes. It is crucial for businesses to accurately complete and submit this form to ensure compliance with tax regulations.

Employers can easily access the IRS 941 Form 2024 printable version online. This allows them to fill out the form manually and submit it to the IRS by mail. Having a printable version of the form makes it convenient for employers to keep track of their quarterly payroll information and stay organized when it comes time to file their taxes.

When filling out the IRS 941 Form 2024, employers will need to provide information such as their employer identification number, total wages paid to employees, federal income tax withheld, and social security and Medicare taxes withheld. It is important to carefully review the form and ensure all information is accurate before submitting it to the IRS.

Employers should also be aware of deadlines for filing the IRS 941 Form 2024. The form must be submitted by the last day of the month following the end of the quarter. Failure to file the form on time or inaccurately can result in penalties and fines from the IRS. By staying organized and keeping track of payroll information throughout the quarter, employers can avoid potential issues when it comes time to file their taxes.

In conclusion, the IRS 941 Form 2024 printable version is a valuable tool for employers to report their quarterly payroll information to the IRS. By accurately completing and submitting this form on time, businesses can ensure compliance with tax regulations and avoid penalties. It is important for employers to stay organized and keep track of their payroll information to make the tax filing process smoother. With the convenience of the printable form, employers can easily access and fill out the necessary information to stay on top of their tax obligations.