When it comes to tax season, staying organized is key. One important form that you may need to fill out is the IRS 1096 form. This form is used to summarize information from 1099 forms that have been issued to recipients. It is important to ensure that this form is filled out accurately and submitted on time to avoid any penalties or fines.

Fortunately, the IRS provides a printable version of the 1096 form on their website. This makes it easy for individuals and businesses to access and fill out the form without any hassle. Whether you are a small business owner or an independent contractor, having access to the printable 1096 form can help streamline the tax filing process.

When filling out the IRS 1096 form, it is important to double-check all information to ensure accuracy. This form includes details such as the total number of 1099 forms being submitted, the total amount of payments made, and the payer’s contact information. Any errors on this form could result in delays or issues with your tax filing.

Once you have completed the 1096 form, you will need to submit it to the IRS along with copies of the corresponding 1099 forms. This can typically be done by mail or electronically, depending on the volume of forms being submitted. It is important to keep a copy of the 1096 form for your records in case you need to reference it in the future.

Overall, the printable IRS 1096 form is a valuable tool for individuals and businesses to use during tax season. By ensuring that this form is filled out accurately and submitted on time, you can avoid any potential issues with your tax filing. Be sure to take advantage of the printable version of the 1096 form provided by the IRS to make the tax filing process as smooth as possible.

In conclusion, the IRS 1096 form is an essential document for summarizing information from 1099 forms. By utilizing the printable version of this form, individuals and businesses can easily access and fill out the necessary information. Remember to double-check all details before submitting the form to the IRS to avoid any potential issues with your tax filing.

Download and Print Irs 1096 Form Printable

Printable payroll are ideal for companies that prefer non-digital systems or need hard copies for staff files. Most forms include fields for employee name, date range, total earnings, taxes, and net pay—making them both complete and easy to use.

Take control of your payroll system today with a trusted printable payroll template. Reduce admin effort, minimize mistakes, and maintain clear records—all while keeping your payroll records professional.

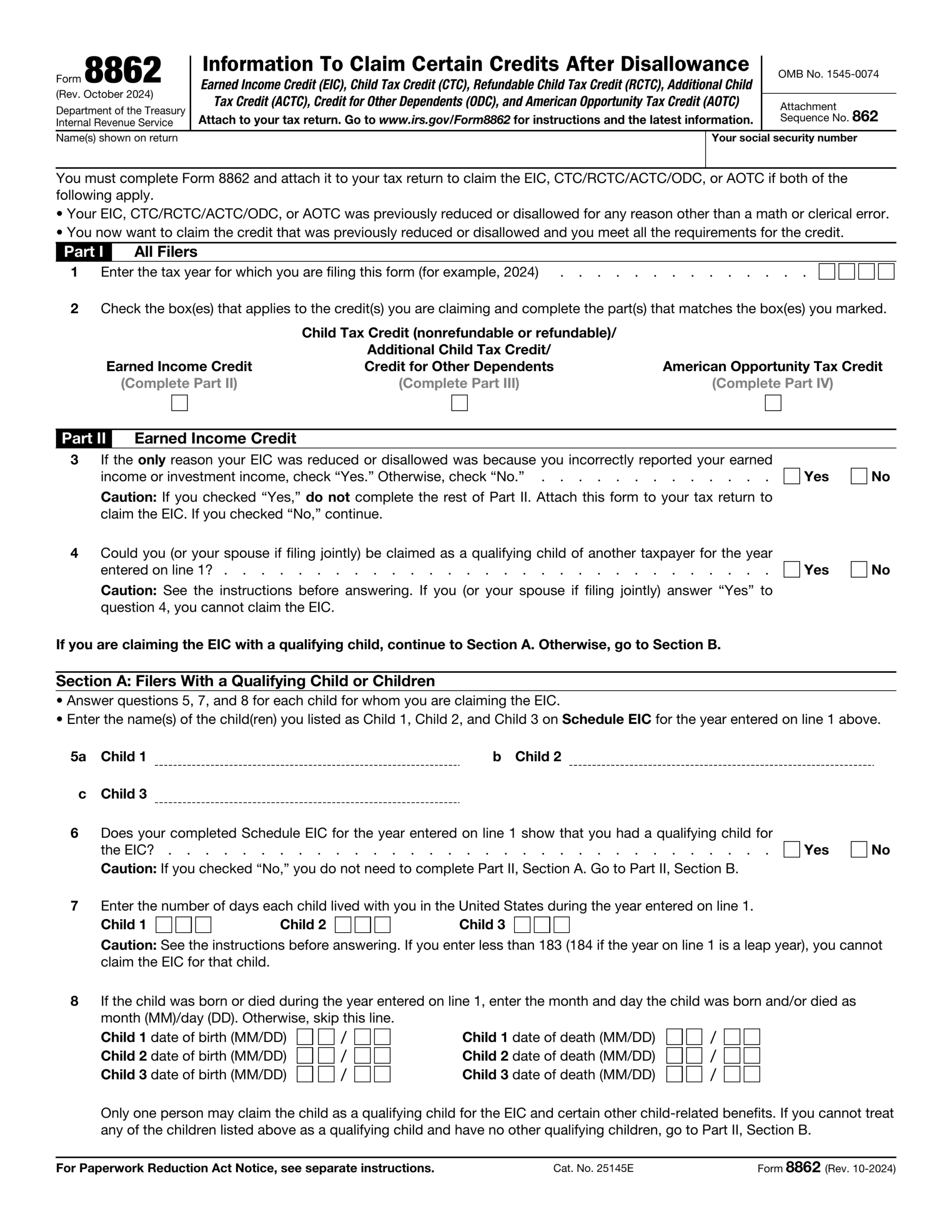

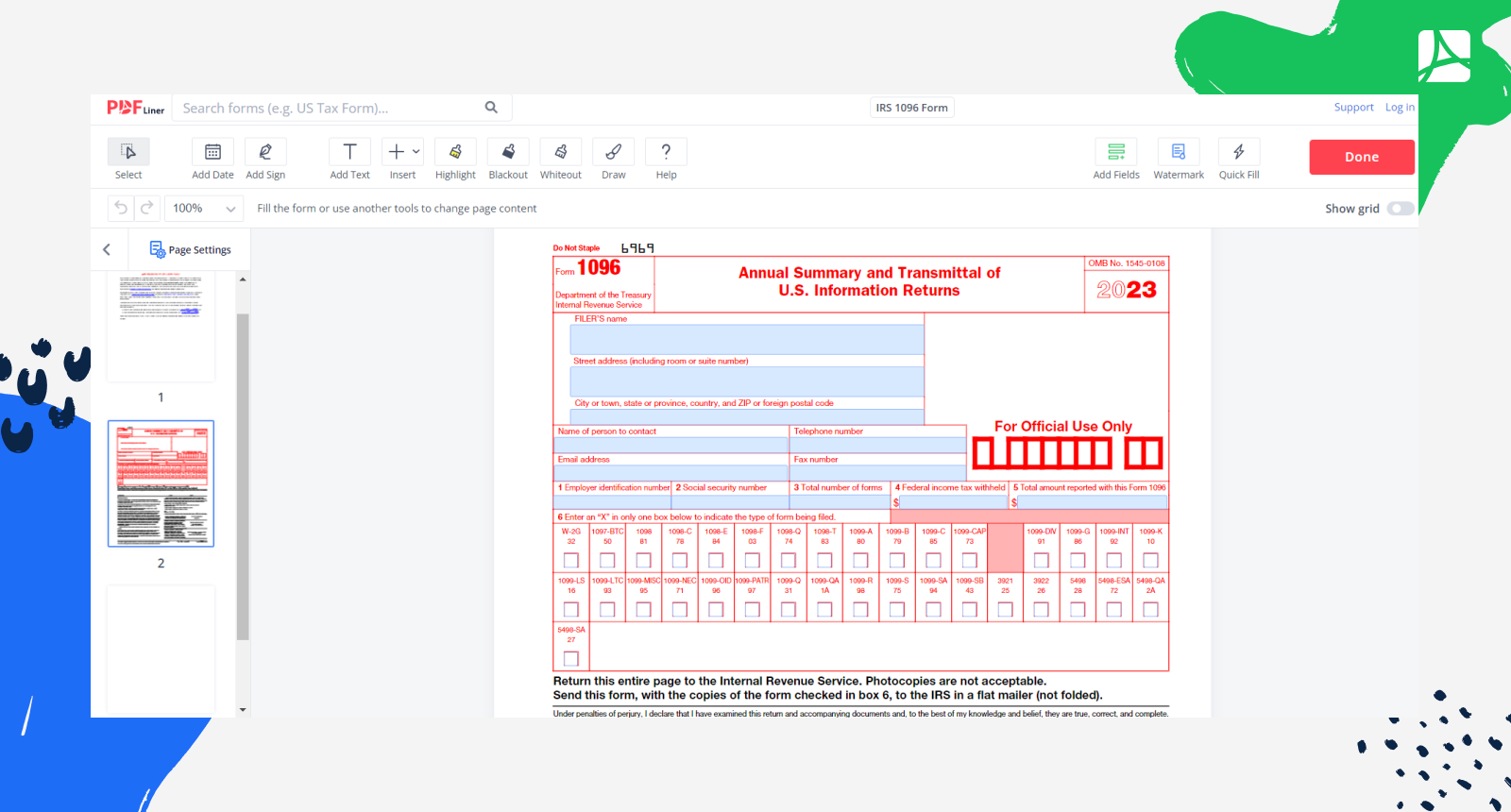

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

IRS 1096 Form 2024 Printable Blank Sign Forms Online PDFliner

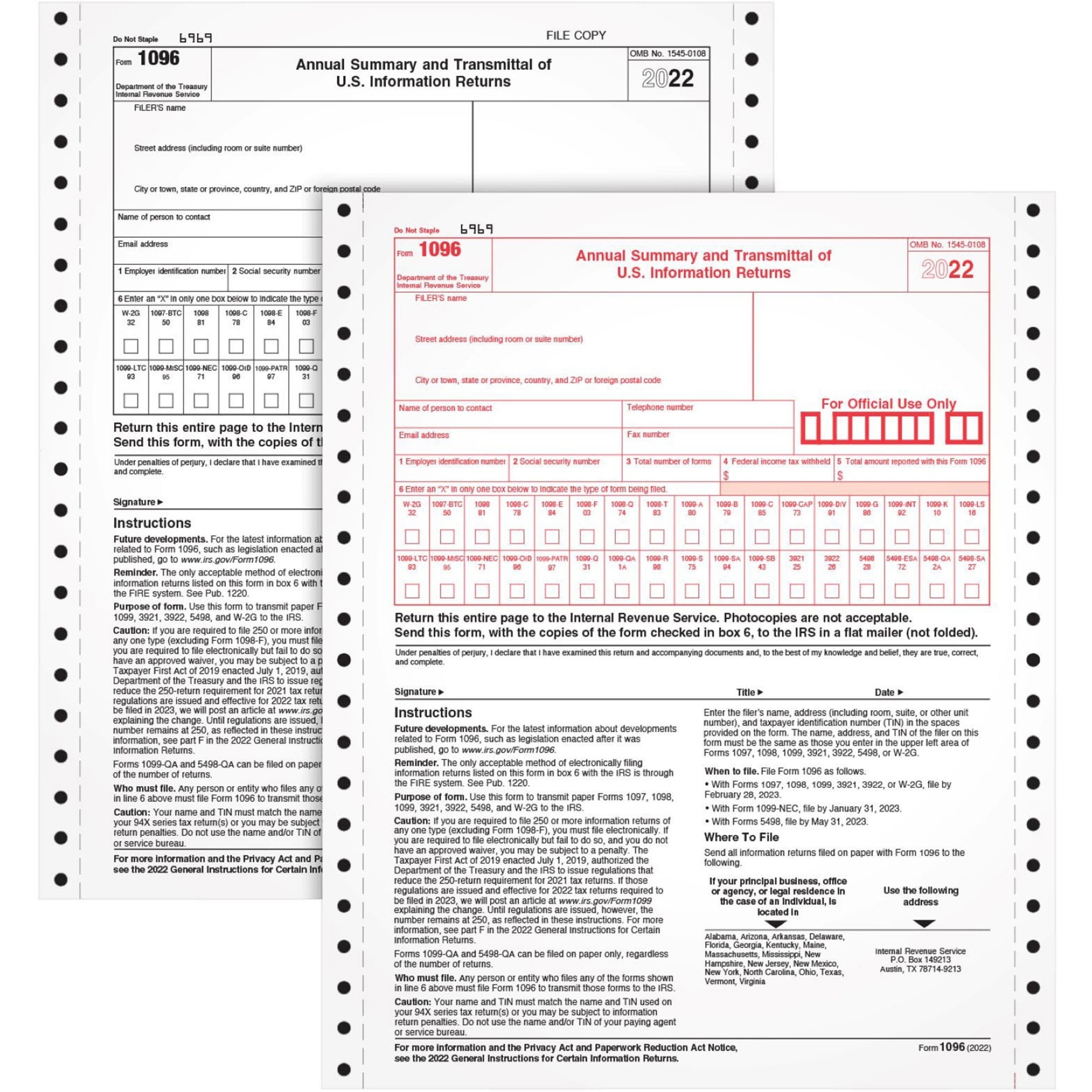

TOPS TOP2202 1096 Tax Form 10 Pack White Walmart

TOPS TOP2202 1096 Tax Form 10 Pack White Walmart

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

Adams 1096 Form Printable Adams 1096 Tax Forms 20 Pack 2024 IRS Compliant Summary Sheets Adams Irs 1096 Printable

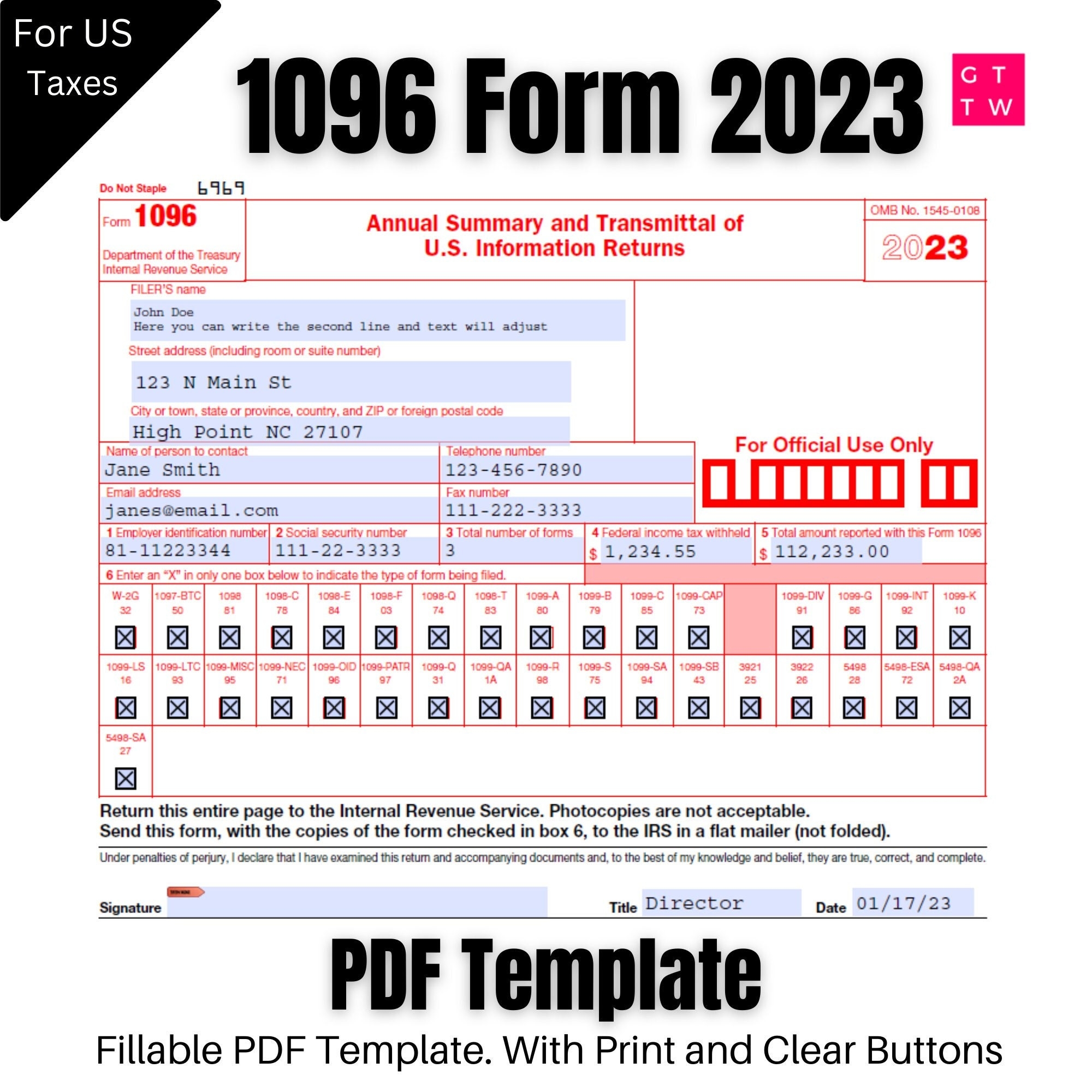

1096 IRS PDF Fillable Template 2023 2024 With Print And Clear Buttons Courier Font Digital Download Etsy

1096 IRS PDF Fillable Template 2023 2024 With Print And Clear Buttons Courier Font Digital Download Etsy

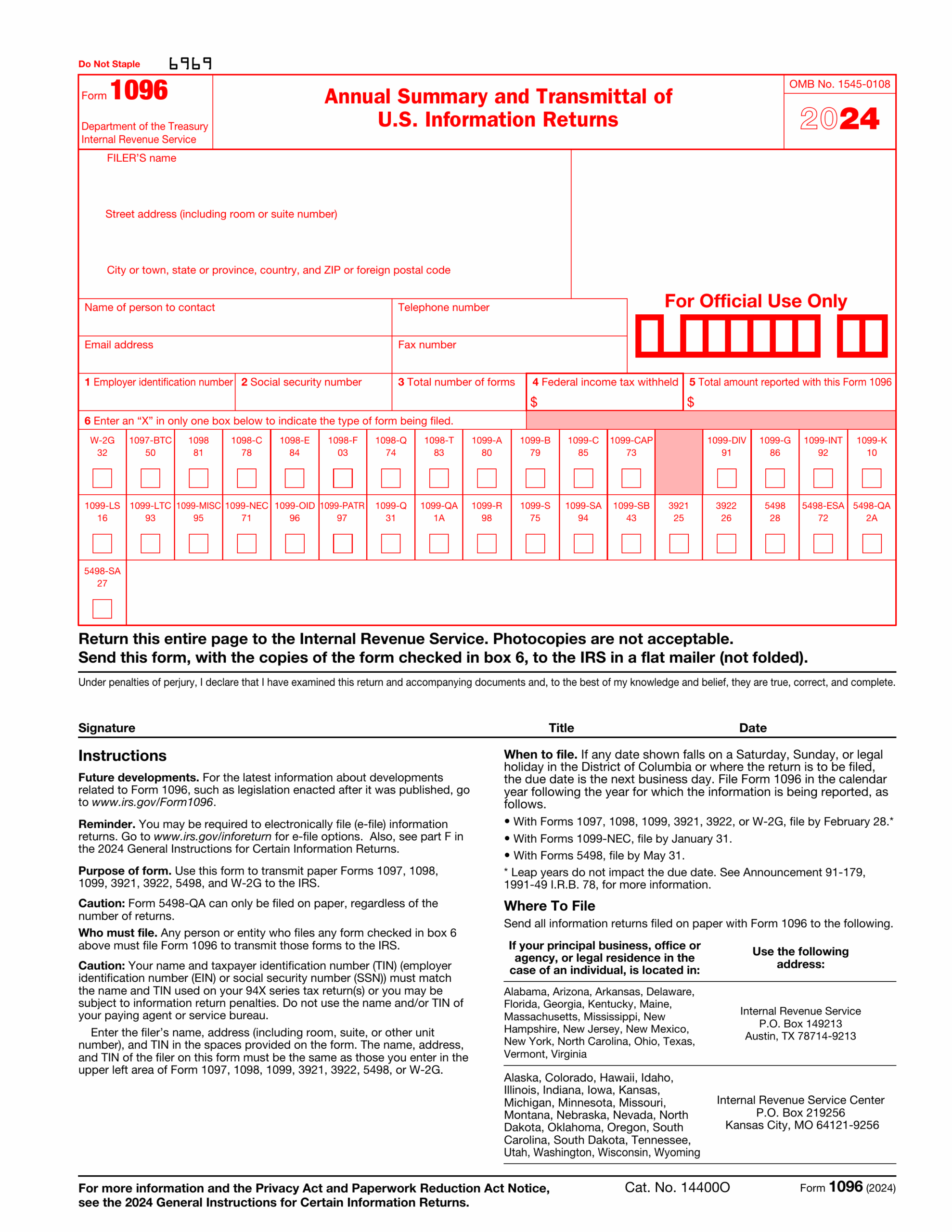

Form 1096 2024 2025 Fill Edit And Download PDF Guru

Form 1096 2024 2025 Fill Edit And Download PDF Guru

Processing staff wages doesn’t have to be difficult. A payroll printable offers a speedy, accurate, and easy-to-use method for tracking employee pay, hours, and taxes—without the need for complex software.

Whether you’re a freelancer, administrator, or independent contractor, using apayroll printable helps ensure compliance with regulations. Simply download the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.