In 2025, the IRS introduced a new version of the W-4r form, which is used by employees to indicate their tax withholding preferences. This updated form aims to simplify the process for both employers and employees, making it easier to accurately calculate tax withholdings.

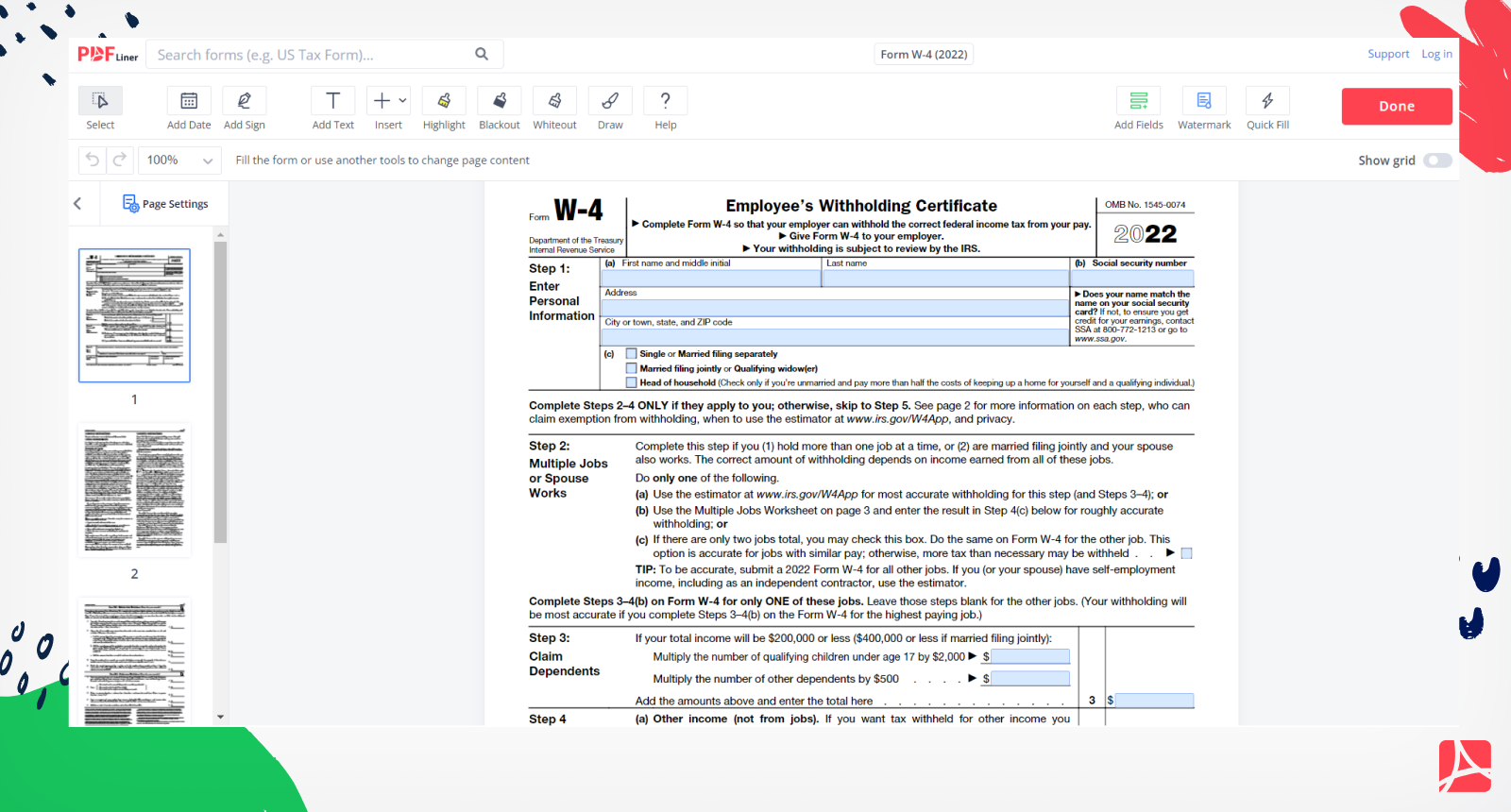

With the 2025 W-4r form printable, employees can easily fill out the necessary information and submit it to their employers. This form includes sections for personal information, filing status, and any additional income or deductions that may affect tax withholding.

One of the key changes in the 2025 W-4r form is the removal of allowances, which were previously used to calculate tax withholdings. Instead, employees now provide their total annual income and any deductions, allowing for a more accurate withholding amount.

Employers can use the information provided on the 2025 W-4r form to calculate the correct amount of federal income tax to withhold from each paycheck. This helps to ensure that employees are not over or under-withheld throughout the year, reducing the likelihood of a large tax bill or refund at the end of the year.

Overall, the 2025 W-4r form printable offers a streamlined and simplified process for employees to indicate their tax withholding preferences. By accurately completing this form, employees can ensure that the correct amount of federal income tax is withheld from their paychecks, avoiding any surprises come tax season.

In conclusion, the 2025 W-4r form printable is a valuable tool for both employees and employers to accurately calculate and withhold federal income tax. By providing detailed information on income, deductions, and filing status, this form helps to ensure that tax withholdings are calculated correctly, leading to a smoother tax season for all parties involved.