As we approach the year 2025, taxpayers are gearing up for another tax season. With technology constantly evolving, the IRS has made it easier for individuals to access and fill out their tax forms online. However, there are still many who prefer the traditional method of printing out their forms and mailing them in. In this article, we will discuss the various IRS printable forms available for the year 2025.

One of the most commonly used IRS printable forms is the 1040 form, which is used by individuals to file their annual income tax return. This form includes sections for reporting income, deductions, and credits. Taxpayers can easily download and print this form from the IRS website or pick up a copy at their local post office or library.

In addition to the 1040 form, there are various schedules and worksheets that may need to be included with your tax return, depending on your individual tax situation. These forms can also be found on the IRS website and printed out for your convenience. Some common schedules include Schedule A for itemized deductions, Schedule C for self-employment income, and Schedule D for capital gains and losses.

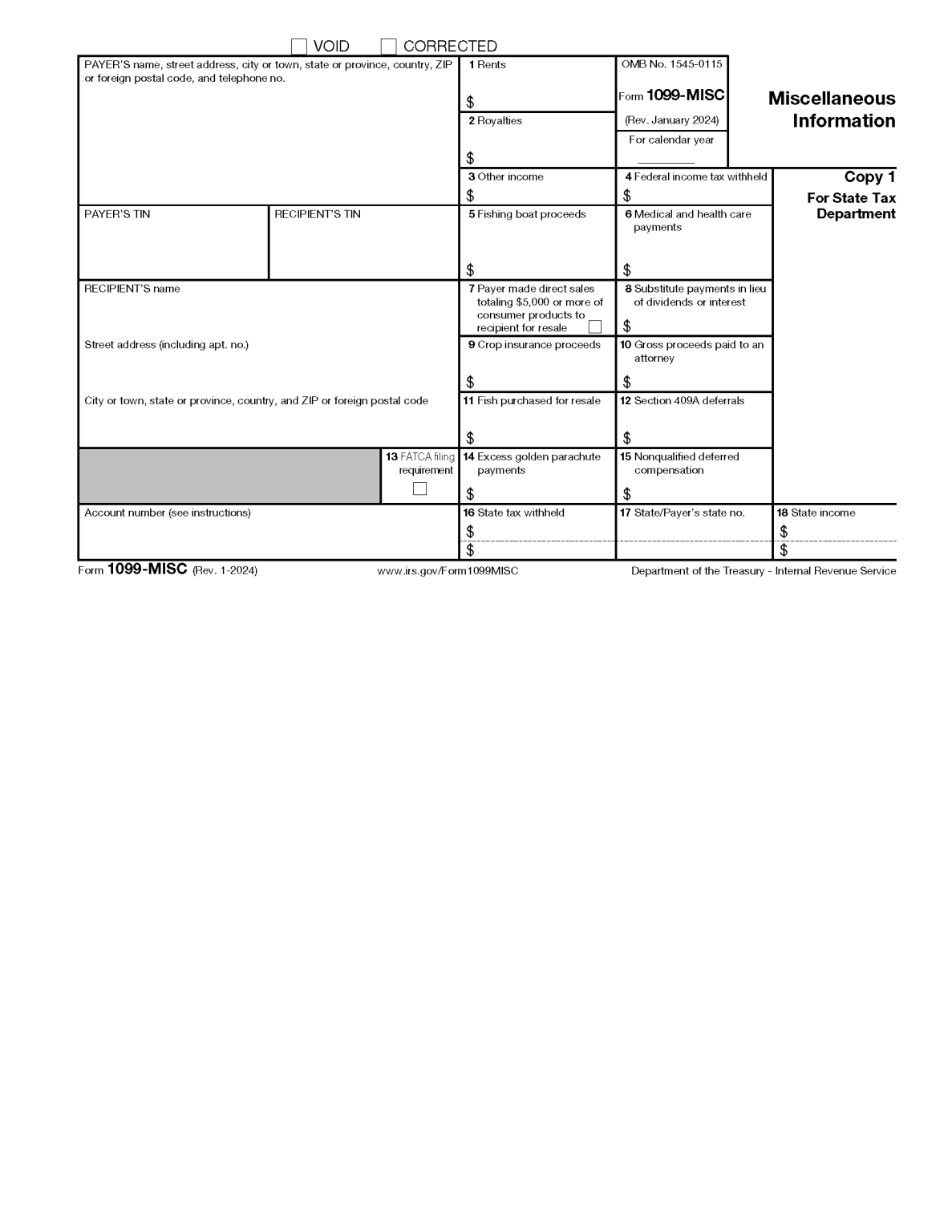

For those who are self-employed or own a small business, the IRS offers printable forms specifically designed for reporting business income and expenses. The Schedule SE form is used to calculate self-employment tax, while the 1099 form is used to report income received as an independent contractor. These forms can be easily accessed and printed out from the IRS website.

It’s important to note that the IRS may update or change certain forms and instructions each year, so it’s crucial to ensure you are using the most current version of the forms for the tax year 2025. By staying organized and keeping track of all necessary forms and documents, you can streamline the tax filing process and avoid any potential errors or delays in receiving your refund.

In conclusion, as we prepare for the tax season in 2025, taxpayers have the option to access and fill out their IRS forms online or opt for the traditional method of printing and mailing in their forms. Whether you choose to go paperless or prefer hard copies, the IRS provides a variety of printable forms to meet your tax filing needs.