Completing your W-4 form is an important step when starting a new job or when you experience life changes that affect your tax status. The W-4 form helps your employer determine how much federal income tax to withhold from your paycheck. It is important to fill out this form accurately to avoid under or over-withholding.

For the year 2024, the W-4 form has been updated to reflect any changes in tax laws or regulations. It is essential to stay informed about these changes to ensure that you are withholding the correct amount of taxes from your paycheck.

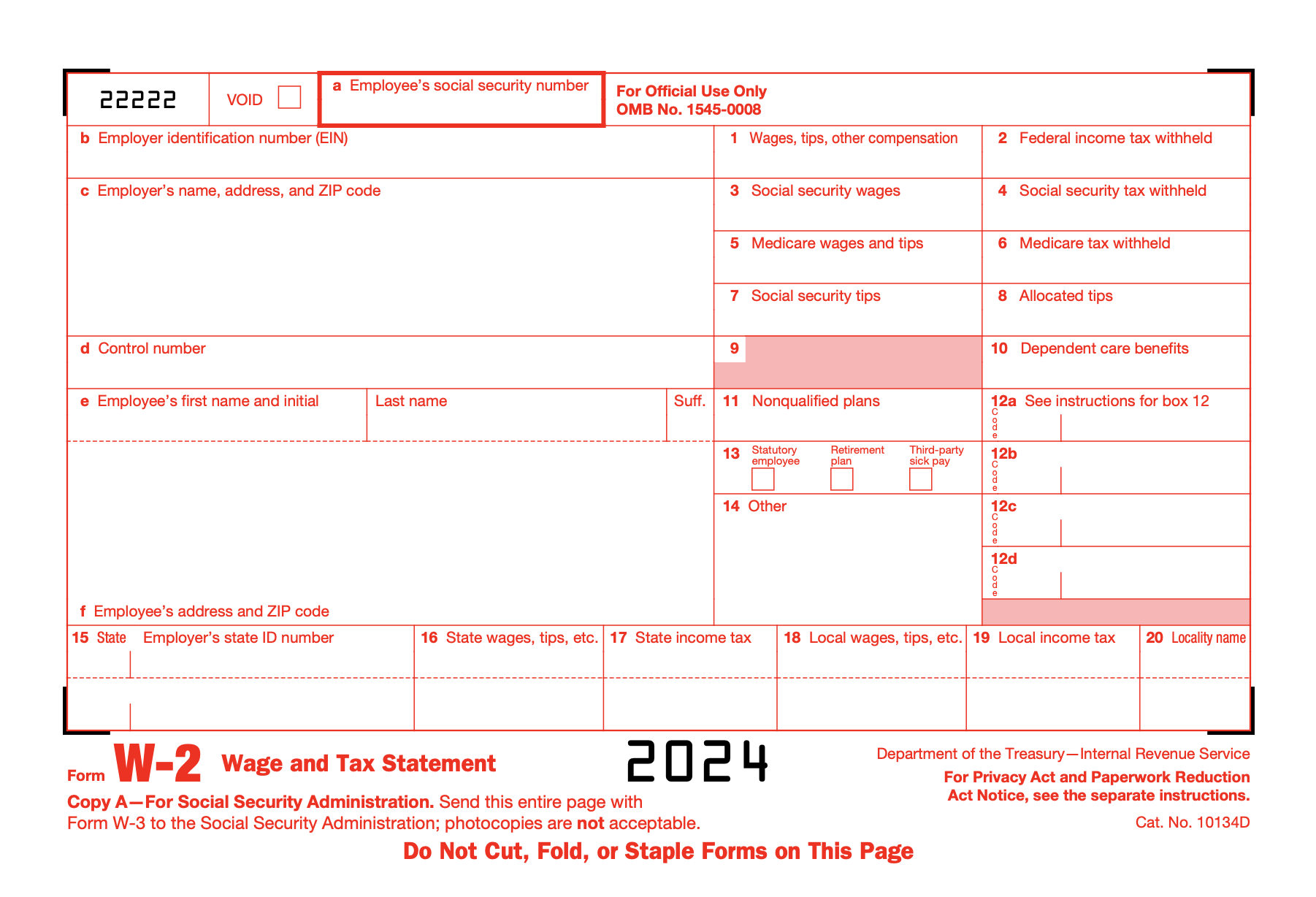

2024 W-4 Form Printable

When looking for a printable version of the 2024 W-4 form, you can easily find it on the official website of the Internal Revenue Service (IRS). The form is available in a PDF format that you can download, print, and fill out manually. Make sure to follow the instructions carefully and provide accurate information to avoid any issues with your tax withholding.

The 2024 W-4 form includes sections where you need to enter personal information such as your name, address, filing status, and number of allowances. Additionally, there are sections for additional income, deductions, and any extra withholding amounts you may want to specify. Take your time to review each section and provide the necessary details.

It is recommended to revisit your W-4 form periodically, especially when you experience changes in your life that may impact your tax situation. Events such as getting married, having children, or changing jobs can all affect how much tax you should withhold. By keeping your W-4 form up to date, you can ensure that you are not overpaying or underpaying your taxes.

Once you have completed the 2024 W-4 form, submit it to your employer for processing. They will use the information provided to calculate the appropriate amount of federal income tax to withhold from your paycheck. It is important to keep a copy of the form for your records and make any necessary adjustments in the future if needed.

In conclusion, the 2024 W-4 form is an essential document that helps determine the amount of federal income tax to withhold from your paycheck. By staying informed about any updates or changes to the form and filling it out accurately, you can ensure that your tax withholding is correct. Remember to review and update your W-4 form as needed to reflect any changes in your tax situation.