As we approach the tax season of 2024, it’s important to stay informed about the latest IRS tax forms that will be required for filing your taxes. Whether you are an individual taxpayer or a business owner, having access to printable tax forms can make the process much smoother and more efficient.

With the ever-changing tax laws and regulations, it’s crucial to have the most up-to-date forms to ensure compliance with the IRS. By utilizing printable tax forms, you can easily fill them out at your convenience and submit them in a timely manner to avoid any penalties or fines.

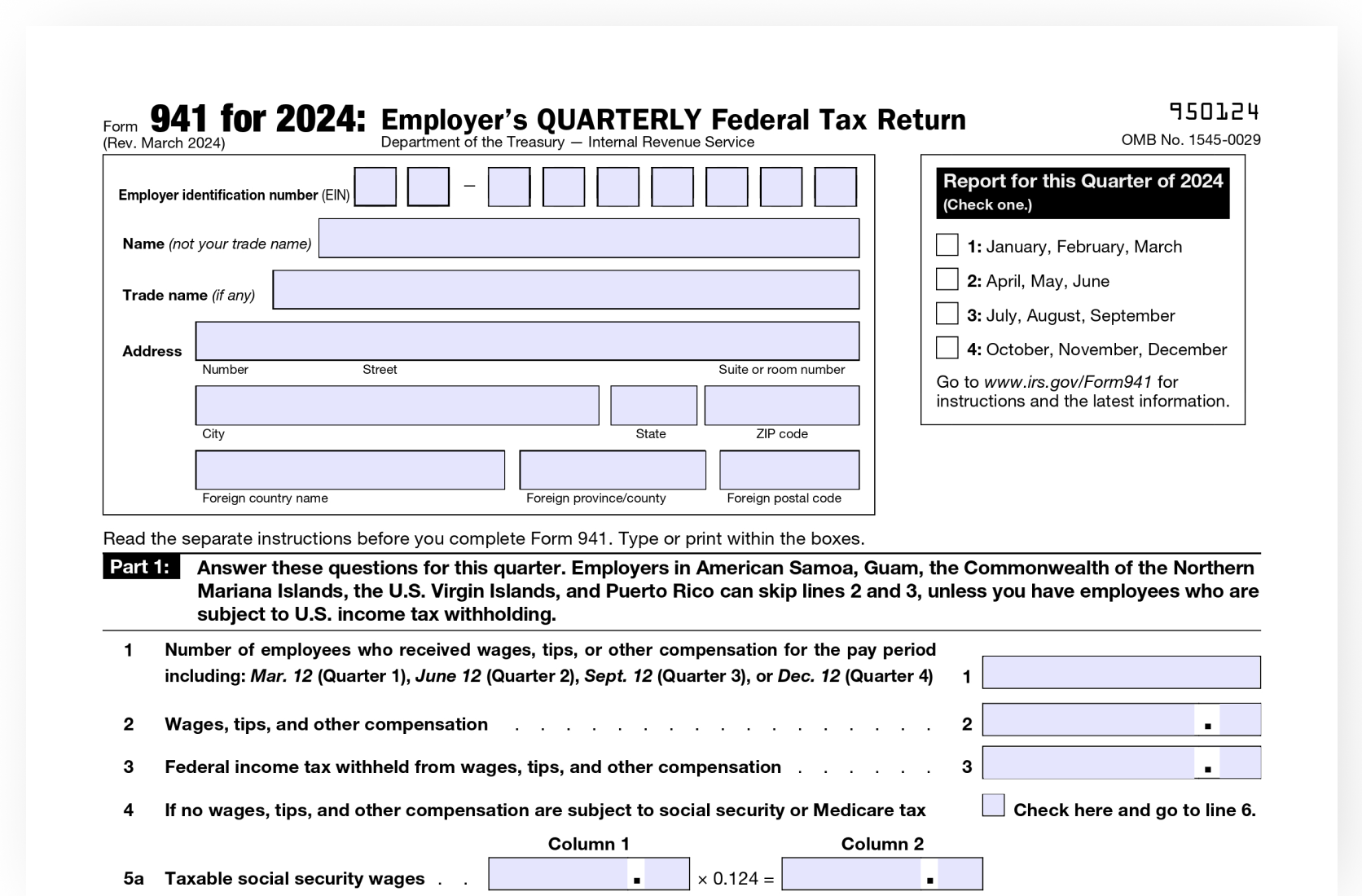

There are a variety of IRS tax forms that may be relevant to your specific tax situation in 2024. From the standard Form 1040 for individual income tax returns to Form 1120 for corporate tax returns, having access to these forms in a printable format can save you time and hassle when it comes to filing your taxes.

In addition to the basic tax forms, there are also numerous schedules, worksheets, and instructions that may be necessary to complete your tax return accurately. By utilizing printable versions of these documents, you can easily reference them as needed and ensure that you are providing all the required information to the IRS.

Whether you choose to file your taxes electronically or by mail, having printable IRS tax forms on hand can streamline the process and help you stay organized throughout the filing process. By being proactive and prepared with the necessary forms, you can alleviate some of the stress associated with tax season and ensure that you are meeting all of your tax obligations.

Overall, having access to printable 2024 IRS tax forms is essential for efficiently filing your taxes and staying compliant with the IRS. By familiarizing yourself with the various forms that may be required for your specific tax situation, you can ensure a smooth and successful tax filing experience.