Filing income taxes can be a daunting task for many individuals. However, having access to printable tax forms can make the process much easier. In 2024, there are various income tax forms that taxpayers can download and print from the comfort of their own homes.

Whether you are an employee, self-employed individual, or business owner, having the necessary tax forms readily available can help you accurately report your income and claim any deductions or credits you may be eligible for.

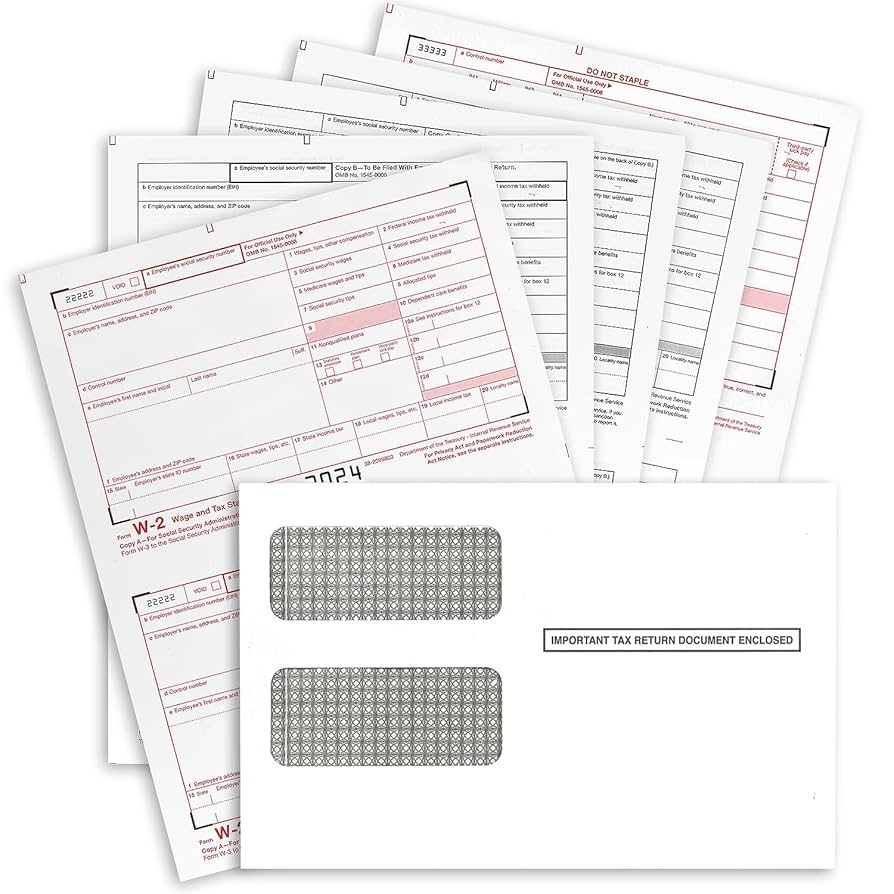

2024 Income Tax Forms Printable

2024 Income Tax Forms Printable

Types of 2024 Income Tax Forms

In 2024, some of the common income tax forms that individuals may need to file their taxes include Form 1040, Form 1040A, and Form 1040EZ. These forms are used to report various types of income, deductions, and credits.

Additionally, self-employed individuals may need to file Schedule C to report their business income and expenses, while business owners may need to file Form 1120 or Form 1065, depending on the type of business entity.

Furthermore, individuals who have income from investments, rental properties, or retirement accounts may need to file additional forms such as Schedule D, Schedule E, or Form 8606.

Having access to printable versions of these forms can make it easier for taxpayers to gather the necessary information and accurately report their income and deductions to the IRS.

It is important to note that tax laws and forms may change from year to year, so it is essential to ensure that you are using the correct forms for the tax year 2024. The IRS website is a valuable resource for accessing up-to-date tax forms and instructions.

In conclusion, having printable 2024 income tax forms can simplify the process of filing taxes for individuals and businesses. By being organized and using the correct forms, taxpayers can ensure that they are compliant with tax laws and maximize their tax savings. Take advantage of the convenience of printable tax forms to streamline your tax filing process.