As tax season approaches, many individuals and businesses are gearing up to file their taxes for the year 2024. One of the most important aspects of this process is ensuring that you have the necessary forms to accurately report your income and deductions. The IRS provides a variety of forms that taxpayers can use to file their federal taxes, and it’s important to know where to find them.

Whether you are a salaried employee, self-employed individual, or small business owner, there are specific forms that you will need to fill out in order to comply with federal tax laws. These forms can be easily accessed online and printed out for your convenience. By having these forms on hand, you can ensure that you are prepared to file your taxes accurately and on time.

2024 Federal Tax Forms Printable

2024 Federal Tax Forms Printable

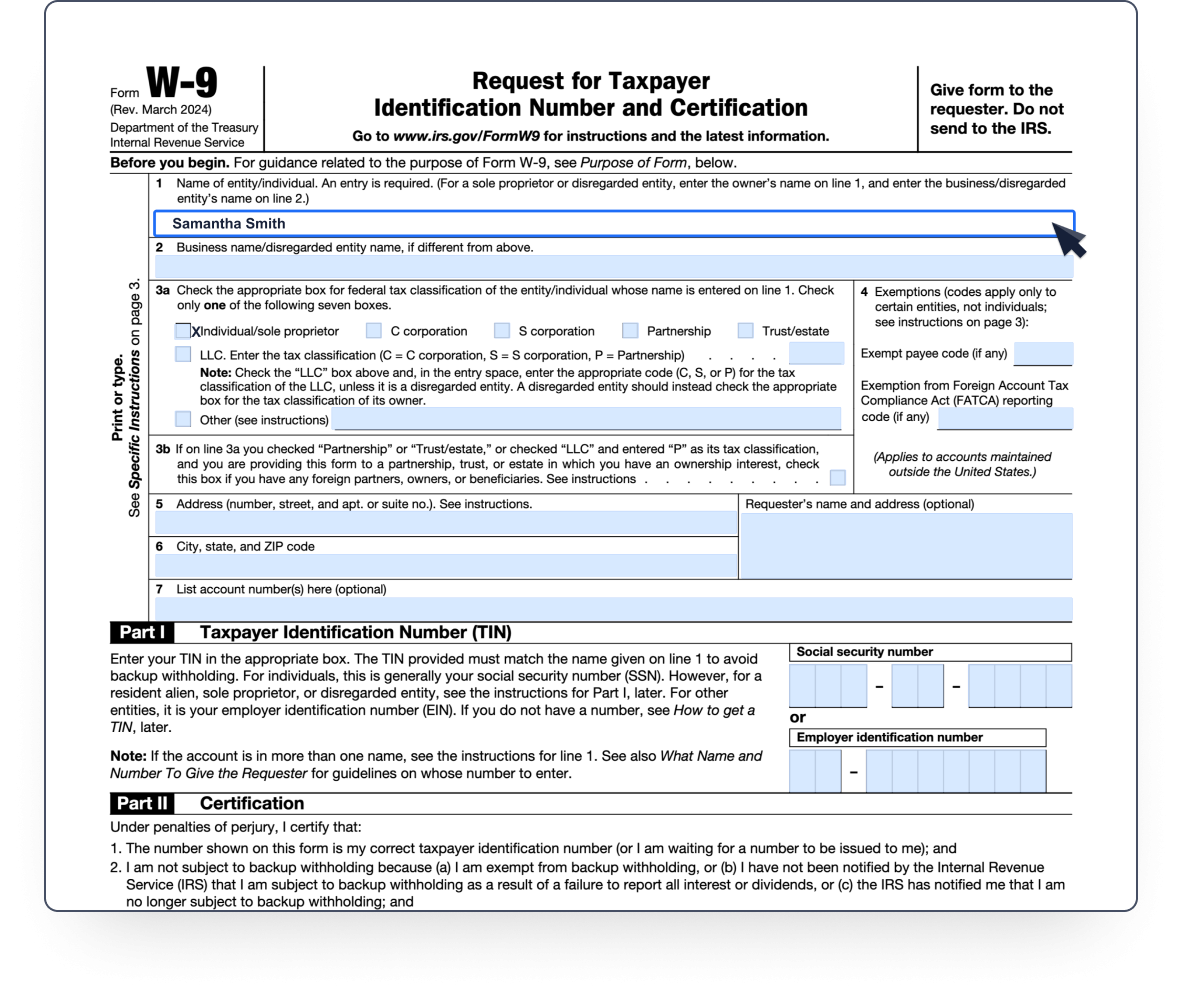

Some of the most common federal tax forms that individuals may need to fill out include Form 1040 for individual income tax returns, Form 1099 for reporting various types of income, and Form W-2 for reporting wages and salaries. Additionally, businesses may need to file forms such as Form 1120 for corporate tax returns or Form 1065 for partnership tax returns. By familiarizing yourself with these forms and their requirements, you can streamline the tax filing process and minimize the risk of errors.

It’s important to note that the IRS regularly updates its forms and instructions, so it’s crucial to ensure that you are using the most current versions of the forms when filing your taxes. The IRS website is a valuable resource for finding and downloading printable versions of federal tax forms, as well as instructions for filling them out correctly. Additionally, tax preparation software and professional tax preparers can also help guide you through the process and ensure that you are meeting all legal requirements.

In conclusion, having access to printable 2024 federal tax forms is essential for individuals and businesses looking to file their taxes accurately and efficiently. By familiarizing yourself with the various forms and their requirements, you can navigate the tax filing process with confidence and avoid potential penalties for non-compliance. Be sure to stay informed about any updates or changes to tax laws and forms, and don’t hesitate to seek assistance if you are unsure about how to proceed with your tax filing.