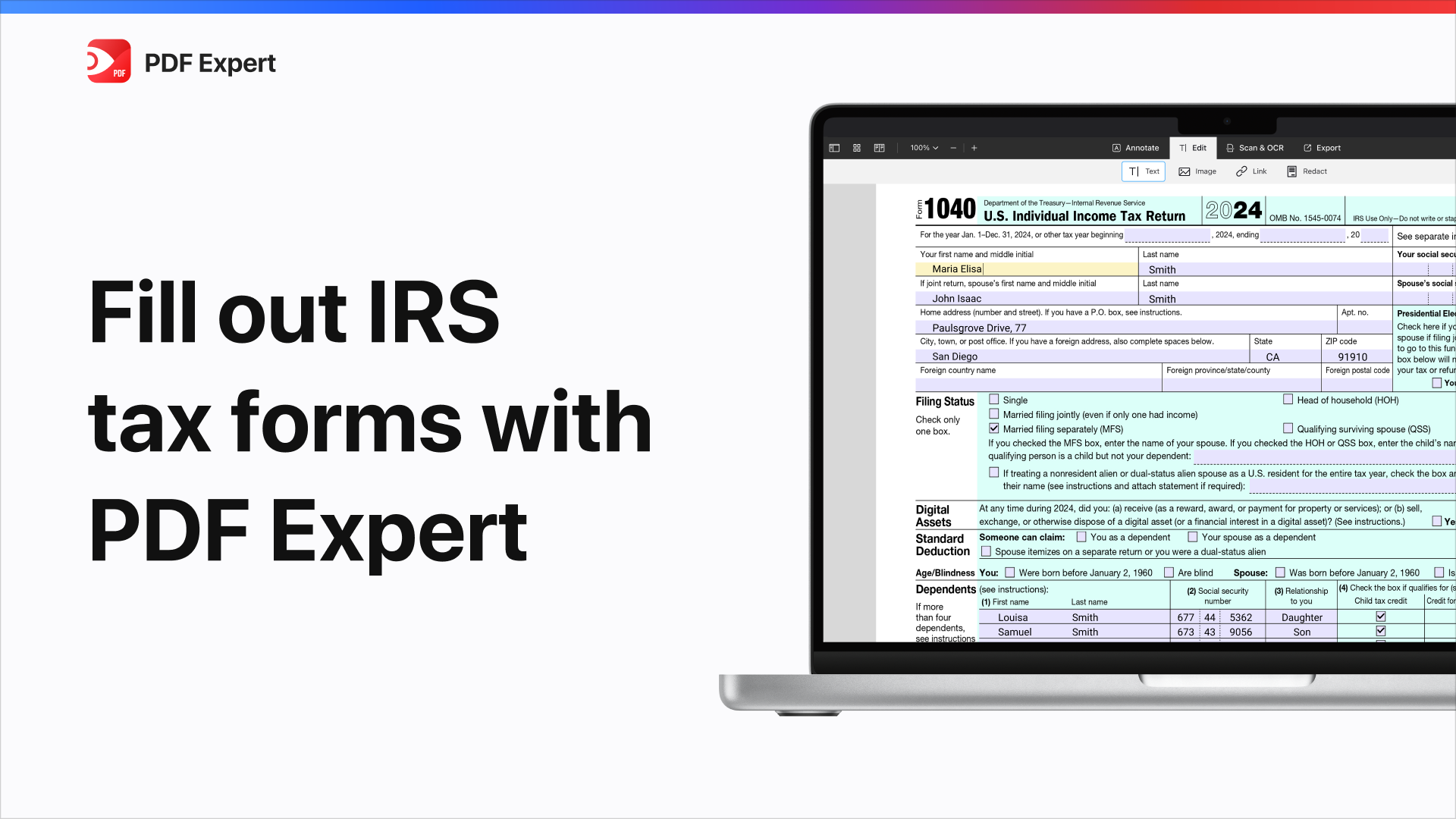

As we approach tax season, it’s important to familiarize yourself with the latest tax forms and instructions. The 2023 Form 1040 is a key document that individuals use to file their federal income taxes. Understanding how to properly fill out this form can help ensure that you accurately report your income and deductions, ultimately leading to a smoother tax filing process.

Whether you are a seasoned taxpayer or a first-time filer, having access to the 2023 Form 1040 instructions in a printable format can be incredibly helpful. This allows you to easily reference the guidelines and requirements as you work through your tax return, ensuring that you don’t miss any important details or make costly mistakes.

2023 Form 1040 Instructions Printable

2023 Form 1040 Instructions Printable

2023 Form 1040 Instructions Printable

The 2023 Form 1040 instructions cover a wide range of topics, including how to report various types of income, claim deductions and credits, and calculate your tax liability. It’s important to carefully review these instructions to ensure that you are following the correct procedures and maximizing your tax savings.

One key aspect of the 2023 Form 1040 instructions is the section on deductions and credits. This is where you can potentially lower your tax bill by claiming expenses such as mortgage interest, medical expenses, and charitable contributions. By understanding the eligibility requirements for each deduction and credit, you can make sure that you are taking full advantage of all available tax breaks.

Additionally, the 2023 Form 1040 instructions provide guidance on how to accurately report your income from various sources, such as wages, investments, and self-employment. By carefully documenting and reporting your income, you can avoid potential IRS audits and penalties, while also ensuring that you are paying the correct amount of tax.

In conclusion, having access to the 2023 Form 1040 instructions printable can greatly simplify the tax filing process and help you accurately report your income and deductions. By following these instructions carefully and seeking assistance from a tax professional if needed, you can ensure that your tax return is completed correctly and in compliance with IRS regulations.