1099 printable forms are essential documents used by businesses to report various types of income they have paid out during the year to independent contractors, freelancers, or other non-employee individuals. These forms are typically used to report income such as fees, royalties, rent, and other types of payments that are not considered salaries or wages.

Businesses are required to provide these forms to the recipients and the IRS by specific deadlines each year. Failing to file these forms on time can result in penalties and fines, so it is crucial for businesses to ensure they have the correct information and forms ready for distribution.

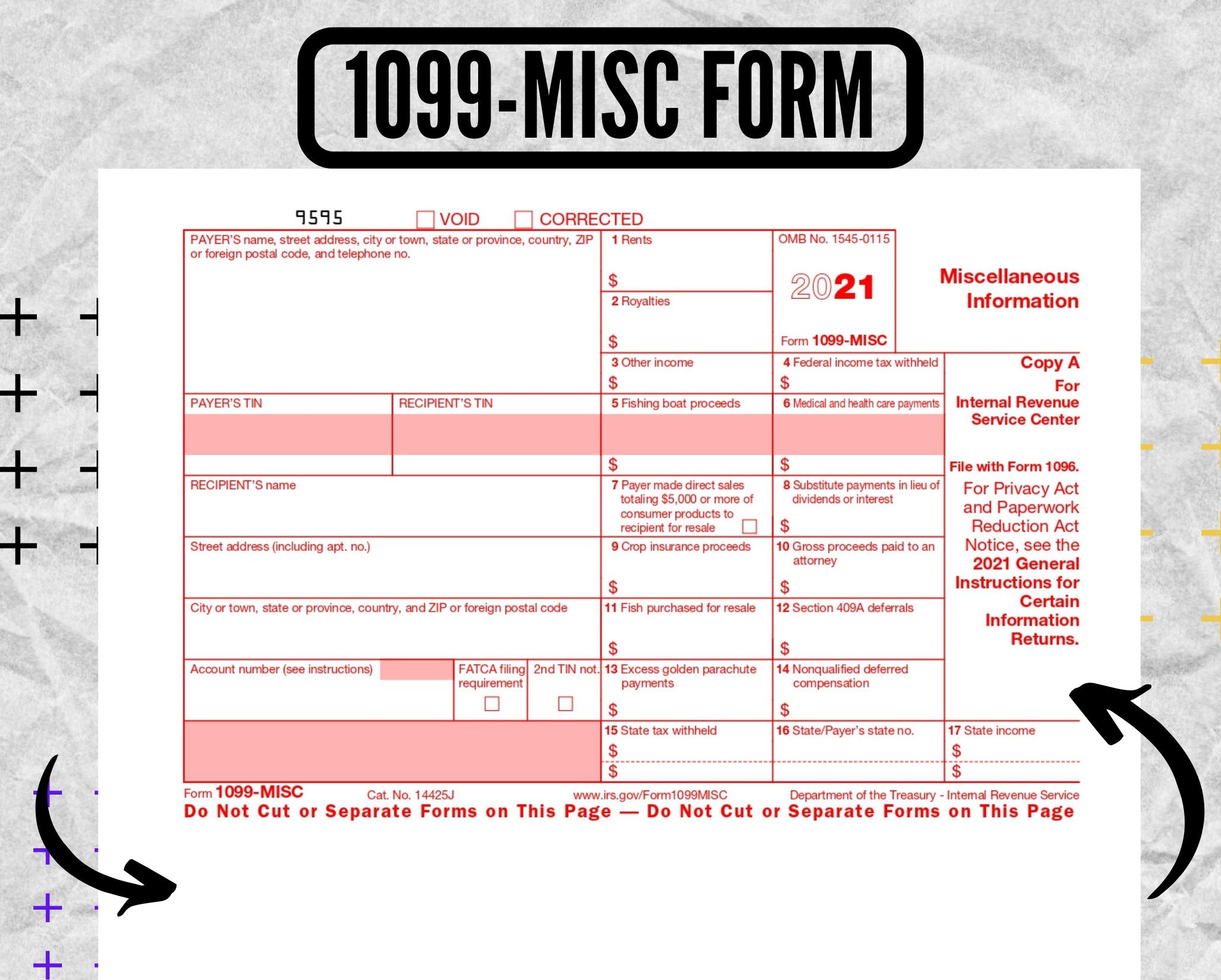

There are different types of 1099 forms, each designated for specific types of income. Some common types include 1099-MISC, 1099-INT, and 1099-DIV. It is important for businesses to determine which form is appropriate for the income they are reporting and to ensure that the information is accurately filled out.

Many businesses choose to use printable 1099 forms to simplify the process of reporting income and ensure compliance with IRS regulations. These forms can be easily downloaded from the IRS website or other reputable sources and printed out for distribution.

Using printable 1099 forms can save businesses time and money by eliminating the need to purchase pre-printed forms or hire professional services to handle the reporting process. With the convenience of printable forms, businesses can easily generate multiple copies as needed and ensure that all necessary parties receive the required documentation.

In conclusion, 1099 printable forms are essential tools for businesses to report various types of income to the IRS and recipients. By using these forms, businesses can streamline the reporting process, avoid penalties for late filing, and ensure compliance with tax regulations. It is important for businesses to familiarize themselves with the different types of 1099 forms and to use printable forms to simplify the reporting process.