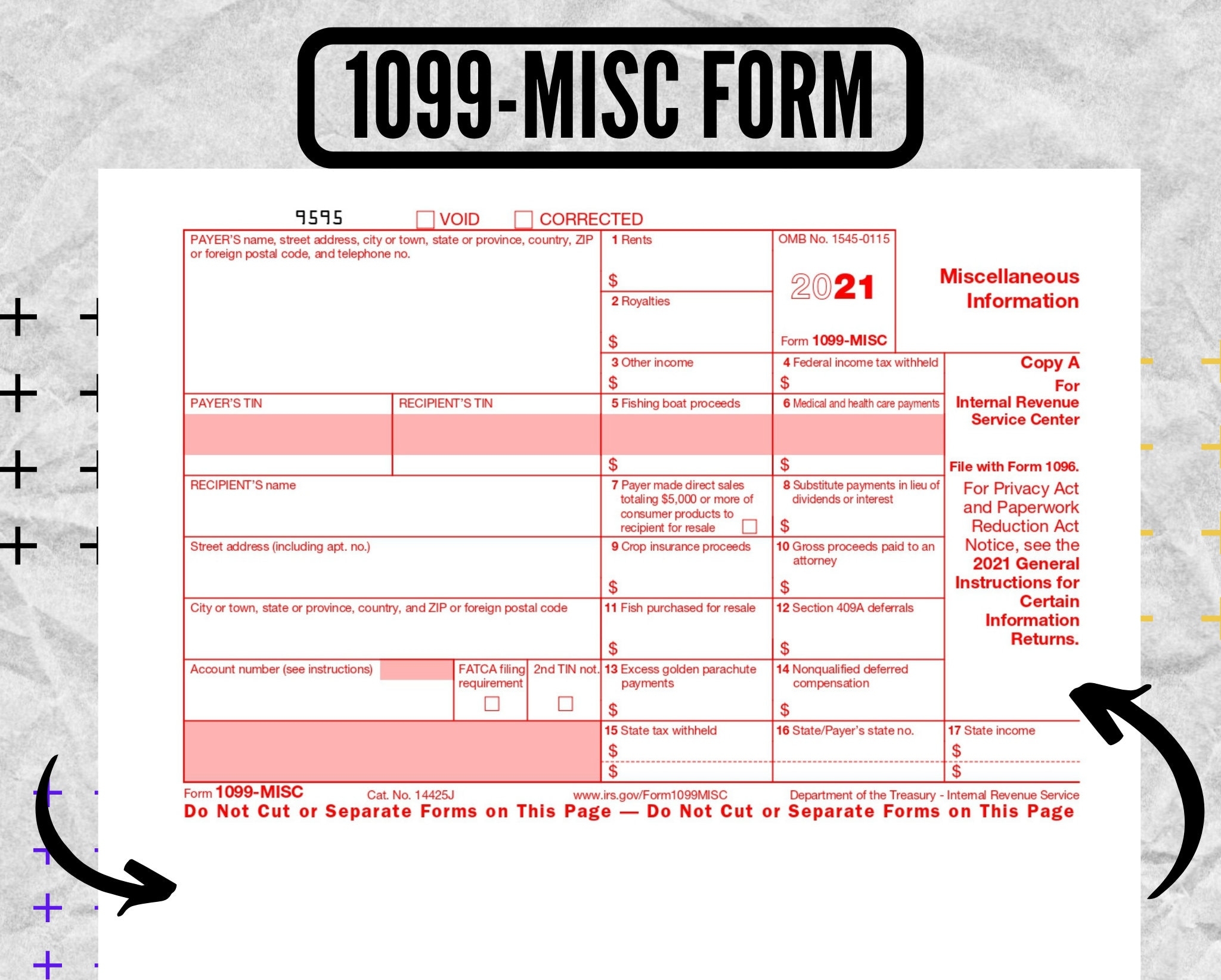

As tax season approaches, many individuals and businesses are starting to gather all the necessary paperwork to file their taxes. One important form that may be needed for tax filing is the 1099 form. This form is used to report various types of income received throughout the year, such as freelance work, rental income, or investment earnings.

For those who have received income that requires a 1099 form, it is essential to have the form filled out correctly and submitted to the IRS by the appropriate deadline. Luckily, there are printable versions of the 1099 form available online, making it easy for individuals to access and complete the form from the comfort of their own home.

When using a printable 1099 form, it is important to double-check all the information entered on the form for accuracy. Any mistakes or inaccuracies could potentially lead to delays in tax processing or even penalties from the IRS. It is always a good idea to consult with a tax professional if you are unsure about how to properly fill out the form.

In addition to printing out the 1099 form, individuals may also opt to file their taxes electronically. Many tax-filing software programs offer the option to input the information from the 1099 form directly into the system, making the process even more convenient and efficient.

Overall, the availability of printable 1099 forms has made the tax-filing process much more manageable for individuals and businesses alike. By ensuring that all income is properly reported and documented, taxpayers can avoid potential issues with the IRS and ensure that their taxes are filed accurately and on time.

As tax season approaches, be sure to take advantage of printable 1099 forms to make the tax-filing process as smooth as possible. Whether you choose to fill out the form by hand or electronically, be sure to double-check all the information before submitting it to the IRS. With the right tools and resources, filing your taxes can be a straightforward and stress-free experience.