As tax season approaches, it’s important to make sure you have all the necessary forms to accurately report your income. One crucial form that many individuals and businesses need to be aware of is the 1099 IRS form. This form is used to report various types of income that are not included on a W-2 form, such as freelance earnings, rental income, and more.

Understanding how to properly fill out and submit the 1099 IRS form is essential to avoiding any potential penalties or audits from the IRS. Luckily, there are printable versions of the form available online, making it easy for you to access and complete it from the comfort of your own home.

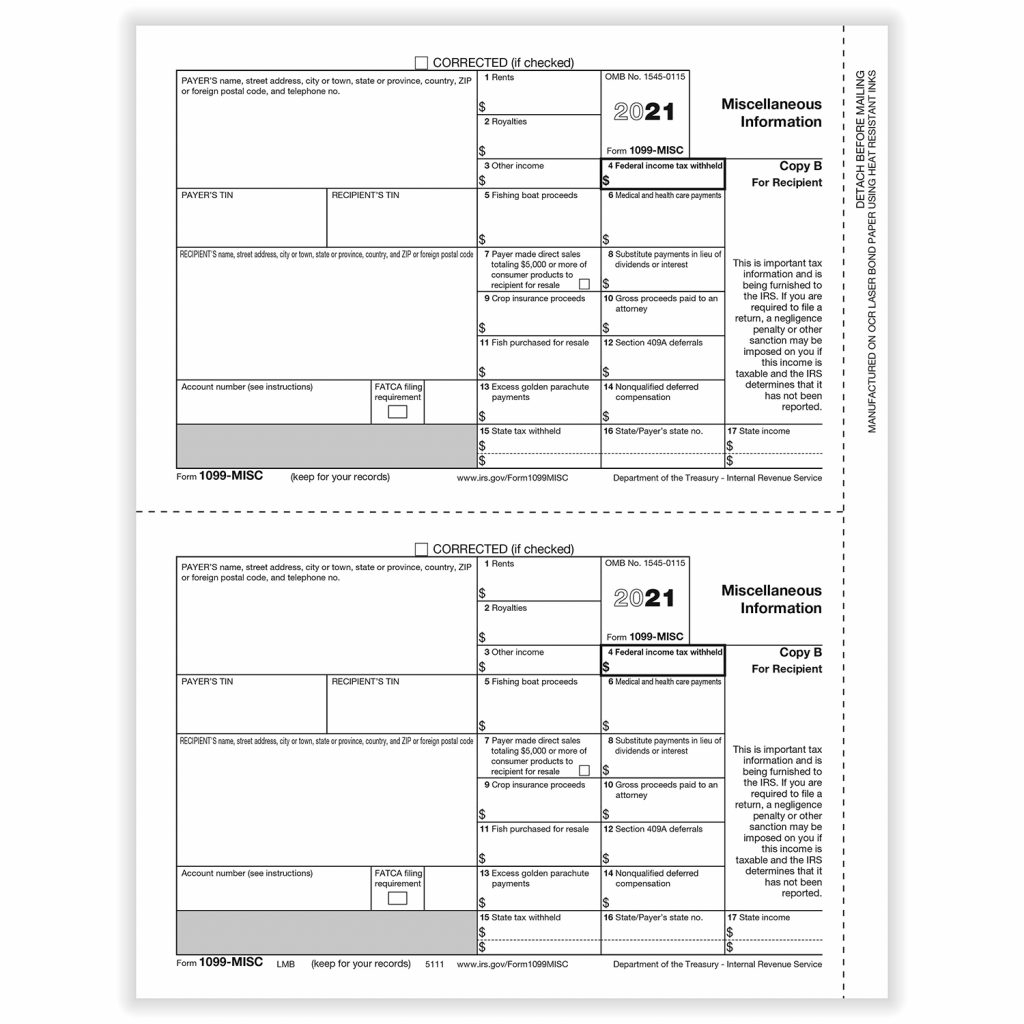

1099 IRS Form Printable

When looking for a printable version of the 1099 IRS form, it’s important to make sure you are using the most up-to-date version provided by the IRS. This form can be found on the official IRS website or through various tax preparation software programs. Once you have the form in hand, you can begin filling in the necessary information, including your identification details, income amounts, and any applicable deductions.

It’s important to note that there are different types of 1099 forms, such as the 1099-MISC for miscellaneous income and the 1099-INT for interest income. Be sure to use the correct form that corresponds to the type of income you are reporting. If you are unsure which form to use, consult with a tax professional for guidance.

Once you have completed the 1099 IRS form, you will need to distribute copies to both the recipient of the income and the IRS by the specified deadline. Failure to do so can result in penalties and fines, so it’s crucial to double-check all information before submitting the form.

In conclusion, the 1099 IRS form is a vital document for reporting various types of income to the IRS. By utilizing the printable version of the form, you can ensure that you are accurately reporting your income and avoiding any potential issues with the IRS. Be sure to stay informed and up-to-date on the latest tax regulations to ensure a smooth and stress-free tax season.