Are you a freelancer or independent contractor who receives income outside of traditional employment? If so, you’re likely familiar with the 1099 form. This form is used to report income earned from sources other than a regular employer, such as self-employment, contract work, or investments. One important thing to note is that you are responsible for reporting this income to the IRS, and the 1099 form is a key part of that process.

As tax season approaches, it’s essential to have all the necessary forms ready to file your taxes accurately and on time. The good news is that you can easily access and print the 1099 form online. Whether you’re a business owner issuing 1099 forms to contractors or a contractor receiving them, having the ability to print these forms from the comfort of your home or office can save you time and hassle.

1099 Form Printable

When it comes to printing the 1099 form, you have a few options. Many reputable websites offer free printable versions of the form that you can download and print at your convenience. Alternatively, you can use tax software to generate and print the form automatically. Whichever method you choose, make sure to double-check that all the information is accurate before submitting it to the IRS.

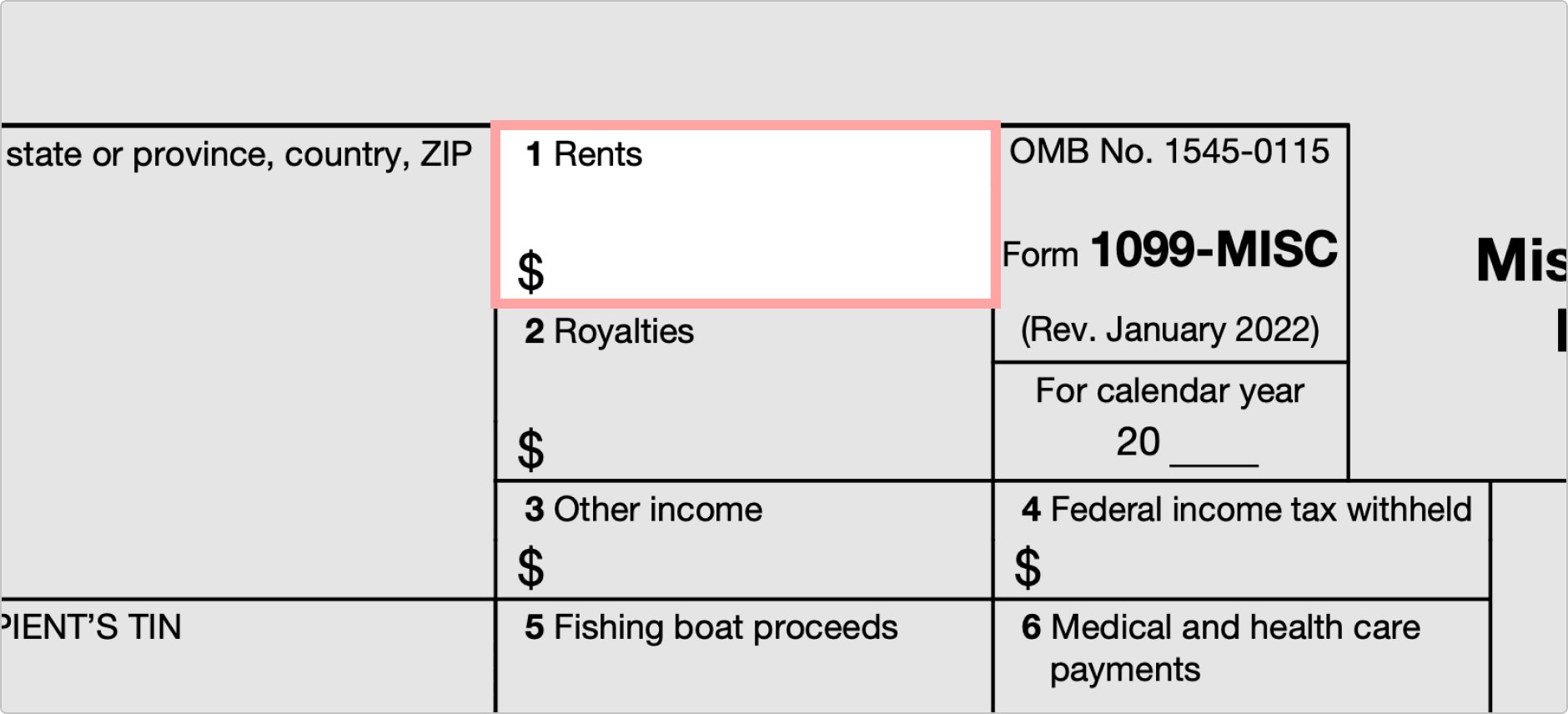

It’s important to note that there are different types of 1099 forms, each corresponding to a specific type of income. For example, the 1099-MISC form is commonly used to report payments made to independent contractors, while the 1099-INT form is used for reporting interest income. Be sure to select the correct form that matches your income sources to avoid any discrepancies or issues with the IRS.

As you prepare to file your taxes, having a printable 1099 form on hand can streamline the process and ensure that you meet your tax obligations. Remember to keep detailed records of all income received throughout the year, as this information will be needed to complete the form accurately. By staying organized and proactive, you can navigate tax season with ease and avoid any potential penalties for non-compliance.

In conclusion, the 1099 form is a crucial document for individuals who receive income from non-traditional sources. With the convenience of printable versions available online, you can easily access and print this form to fulfill your tax obligations. Remember to review the form carefully and seek assistance from a tax professional if needed to ensure accurate reporting. By taking the necessary steps to file your taxes correctly, you can avoid potential issues and enjoy peace of mind during tax season.