Filing taxes can be a daunting task for many individuals, but the 1040ez Printable Form aims to simplify the process for those with straightforward tax situations. This form is designed for taxpayers who have no dependents, do not own a home, and have income from wages, salaries, tips, taxable scholarships, or fellowship grants.

With the 1040ez Printable Form, taxpayers can easily report their income, claim deductions, and calculate their tax liability in a simple and straightforward manner. This form is ideal for individuals who do not need to itemize deductions and have a taxable income of less than $100,000.

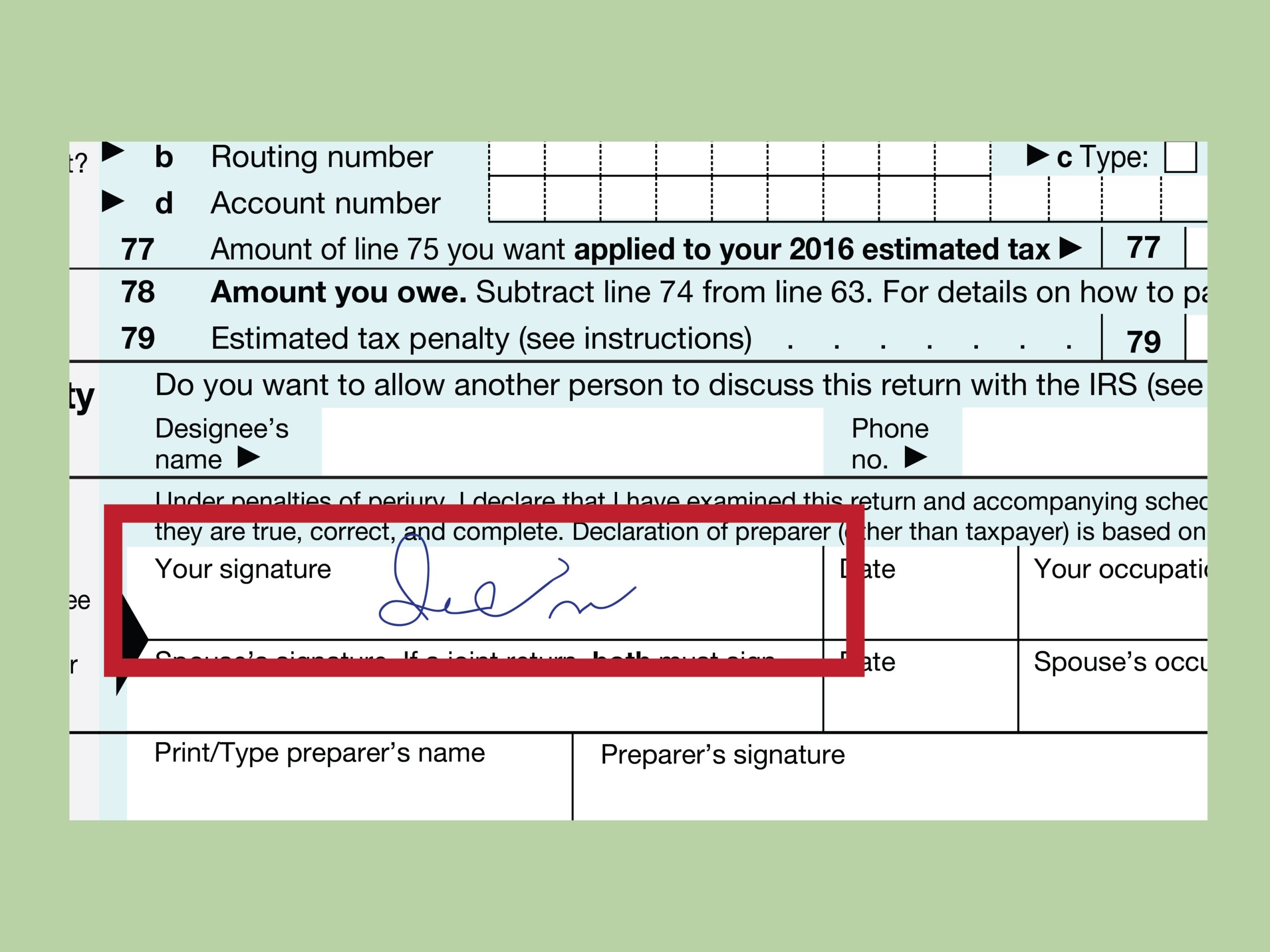

One of the key benefits of the 1040ez Printable Form is its simplicity and ease of use. Taxpayers can quickly fill out the form by providing basic information such as their name, address, social security number, and income details. Additionally, the form includes step-by-step instructions to help individuals complete it accurately.

Another advantage of the 1040ez Printable Form is that it allows taxpayers to file their taxes electronically, making the process faster and more convenient. This form is also available for download on the IRS website, making it easily accessible to those who prefer to file their taxes online.

In conclusion, the 1040ez Printable Form is a convenient and user-friendly option for individuals with simple tax situations. By using this form, taxpayers can easily report their income, claim deductions, and calculate their tax liability without the need for extensive paperwork or calculations. Whether you are a student, young professional, or someone with a basic income, the 1040ez Printable Form can help simplify the tax filing process for you.