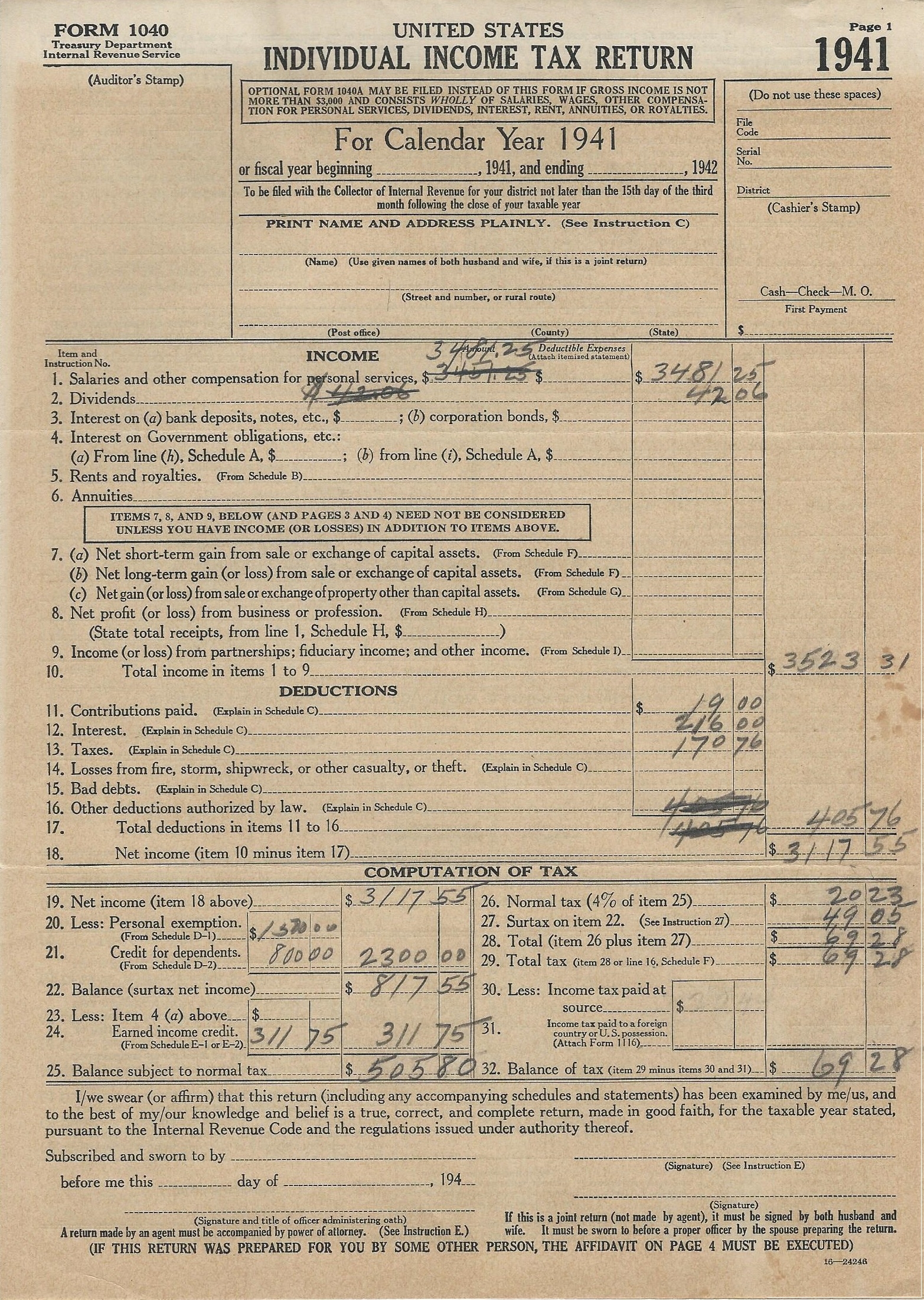

As tax season approaches, many individuals are preparing to file their taxes and are on the lookout for the necessary forms. One of the most commonly used tax forms is the 1040 form, which is used by individuals to report their annual income and calculate their tax liability. While the process of filing taxes can be overwhelming, having access to printable tax forms like the 1040 form can make the process a bit easier.

The 1040 form is the standard form that individuals use to file their income tax returns with the Internal Revenue Service (IRS). This form is used to report various types of income, deductions, and credits, and ultimately calculate the amount of tax owed or refund due. The 1040 form comes in several variations, including the 1040EZ, 1040A, and the standard 1040 form. Printable versions of these forms can be found on the IRS website or through various tax preparation software.

One of the benefits of using printable tax forms like the 1040 form is the convenience it offers. Instead of having to pick up forms from a local IRS office or wait for them to arrive in the mail, individuals can simply download and print the forms they need from the comfort of their own home. This can save time and make the filing process more efficient.

Additionally, using printable tax forms allows individuals to familiarize themselves with the information required and gather the necessary documents before sitting down to complete the form. This can help prevent errors and ensure that the filing process goes smoothly. Printable tax forms also provide a helpful reference for individuals who may have questions about specific sections of the form.

In conclusion, having access to printable tax forms like the 1040 form can simplify the process of filing taxes and help individuals accurately report their income and deductions. By utilizing these forms, individuals can save time, reduce errors, and ensure that their taxes are filed correctly. So, as tax season approaches, be sure to take advantage of printable tax forms to make the filing process as smooth as possible.