As tax season approaches, individuals and businesses alike are gearing up to file their taxes. One essential document that many taxpayers will need is the 1040 Printable Tax Form. This form is used by individuals to report their annual income and calculate their tax liability to the Internal Revenue Service (IRS).

Completing the 1040 form accurately is crucial to avoid any potential penalties or audits from the IRS. It is essential for taxpayers to gather all necessary documents, such as W-2s, 1099s, and receipts, before filling out the form to ensure accuracy and compliance with tax laws.

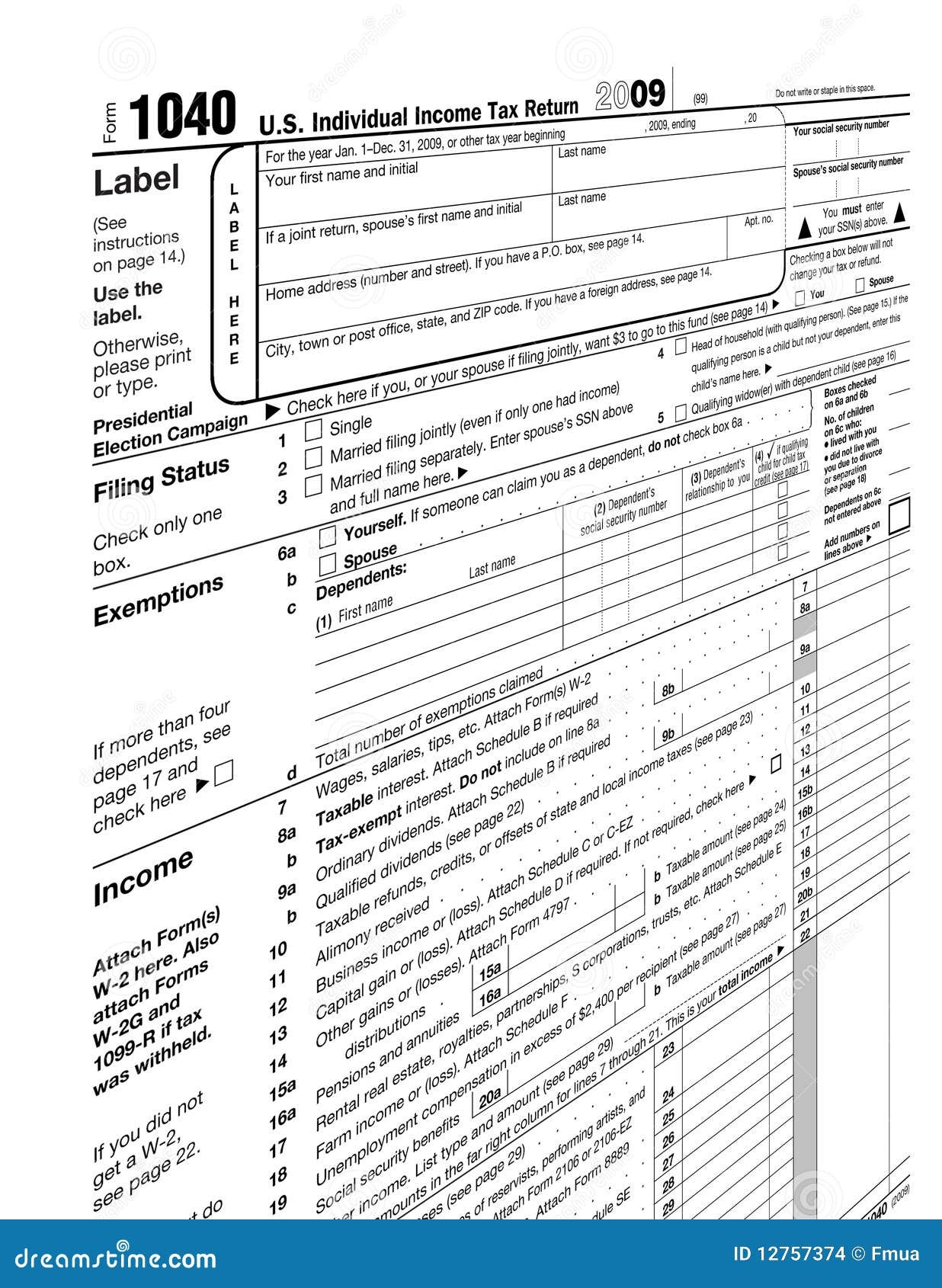

1040 Printable Tax Form

The 1040 form is a standardized form issued by the IRS that taxpayers use to file their annual income tax returns. This form is used by individuals who have taxable income, deductions, and credits to report to the IRS. The 1040 form is divided into several sections, including personal information, income, deductions, credits, and tax liability.

When filling out the 1040 form, taxpayers must provide accurate information about their income, expenses, and any credits or deductions they may be eligible for. It is essential to double-check all entries and calculations to ensure accuracy and avoid any potential errors that could lead to penalties or audits.

Once the 1040 form is completed, taxpayers can either file it electronically or mail it to the IRS along with any required documentation. It is crucial to file the form by the deadline, which is typically April 15th, to avoid any late-filing penalties.

In conclusion, the 1040 Printable Tax Form is a vital document that all taxpayers must complete accurately and submit to the IRS each year. By gathering all necessary documents and carefully filling out the form, taxpayers can ensure compliance with tax laws and avoid any potential penalties or audits. Make sure to file your taxes on time and seek assistance from a tax professional if needed to ensure a smooth tax-filing process.