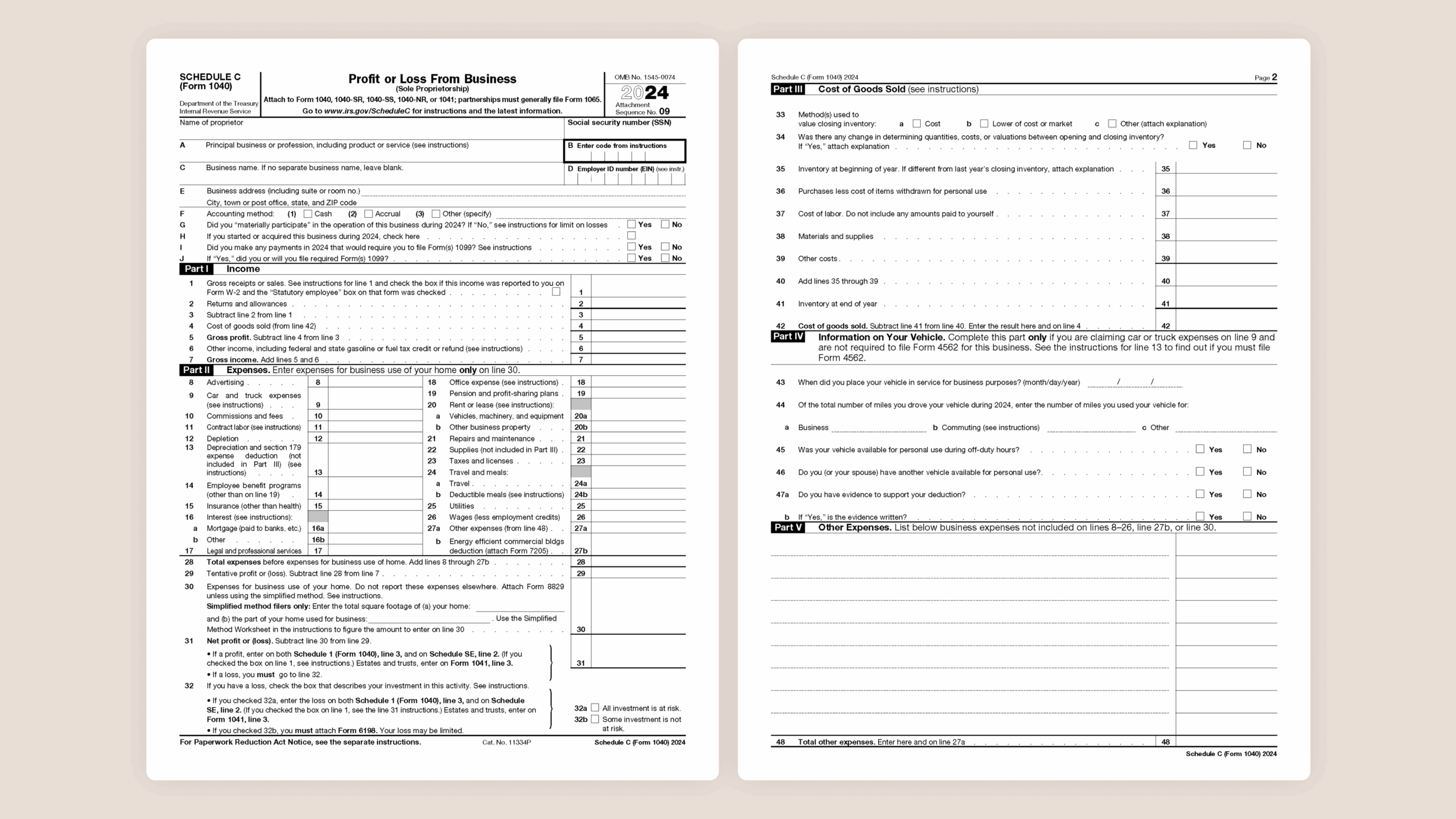

When it comes to filing your taxes, the 1040 IRS form is one of the most common forms used by individuals to report their annual income and calculate their tax liability. This form is used by millions of taxpayers each year to ensure they are in compliance with the tax laws and regulations set forth by the Internal Revenue Service (IRS).

For those who prefer to file their taxes manually rather than electronically, having access to a printable version of the 1040 IRS form is essential. Being able to fill out the form by hand can be a helpful way to ensure accuracy and double-check your information before submitting it to the IRS.

Downloading the 1040 IRS Form Printable

Obtaining a printable version of the 1040 IRS form is easy. Simply visit the official IRS website and navigate to the forms and publications section. From there, you can search for the 1040 form and download the PDF version to your computer or device. Once downloaded, you can easily print the form and begin filling it out with your tax information.

When filling out the 1040 IRS form, it is important to pay close attention to the instructions provided by the IRS. Make sure to accurately report all sources of income, deductions, and credits to ensure your tax return is completed correctly. Additionally, double-check your calculations to avoid any errors that could result in penalties or delays in processing your return.

Once you have completed the 1040 IRS form, you can either mail it to the IRS or submit it electronically using IRS e-file. If mailing the form, make sure to include any necessary documentation, such as W-2 forms or additional schedules. If submitting electronically, follow the instructions provided on the IRS website to ensure your return is processed successfully.

In conclusion, having access to a printable version of the 1040 IRS form is essential for individuals who prefer to file their taxes manually. By following the instructions provided by the IRS and accurately reporting your tax information, you can ensure your tax return is completed correctly and submitted on time.