When it comes to tax season, filling out the necessary forms can be a daunting task. However, with the availability of 1040 form printable, the process has become much simpler and more convenient for taxpayers. These printable forms allow individuals to easily fill out their tax information at their own pace and in the comfort of their own home.

1040 form printable can be easily found online on various websites, including the IRS website. This allows taxpayers to access the forms quickly and without having to wait for them to be mailed out. Additionally, these printable forms come with instructions and guidelines to help individuals accurately fill out their tax information.

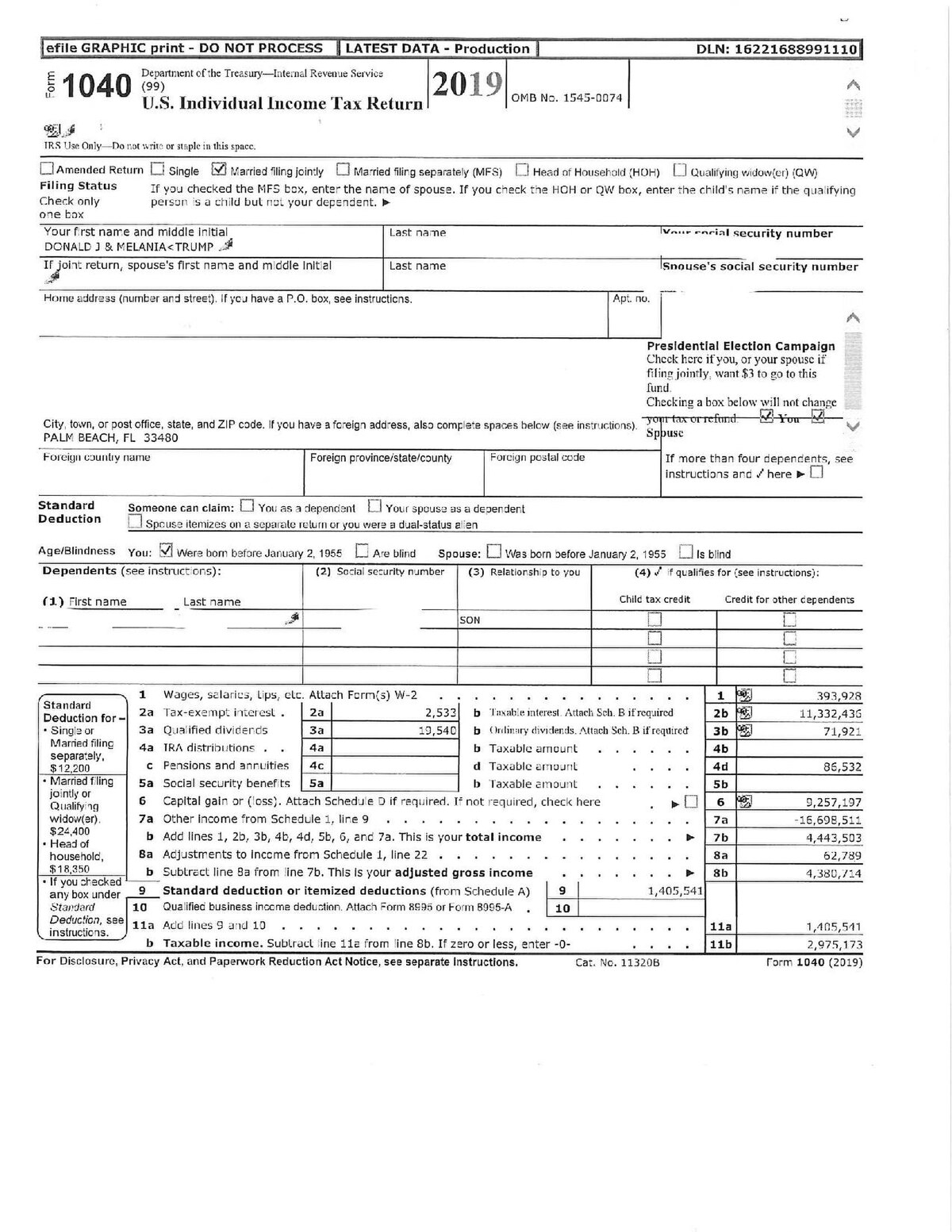

1040 Form Printable

One of the main advantages of using 1040 form printable is the ease of access and convenience it provides. Taxpayers no longer have to worry about making errors on handwritten forms or waiting in long lines at the post office to pick up forms. With just a few clicks, individuals can download and print the necessary forms right from their computer.

Furthermore, 1040 form printable also allows for better organization of tax documents. Individuals can easily save digital copies of the forms for future reference, making it easier to track their tax history and compare information from previous years. This can be especially helpful for individuals who have multiple sources of income or who need to file taxes for various entities.

In addition, using 1040 form printable can help individuals save time and money. By filling out the forms electronically, taxpayers can avoid the costs associated with printing and mailing paper forms. This not only saves money on postage and printing supplies but also reduces the environmental impact of using paper forms.

In conclusion, 1040 form printable offers a convenient and efficient way for individuals to file their taxes. With easy access, clear instructions, and the ability to save and track tax documents, printable forms have become a popular choice for taxpayers. By utilizing these forms, individuals can streamline the tax filing process and avoid common pitfalls associated with paper forms.