As tax season approaches, it’s important for freelancers, independent contractors, and small business owners to familiarize themselves with the various tax forms they may need to file. One such form is the 1099 form, which is used to report income other than salaries, wages, and tips. This form is crucial for those who receive income from sources such as freelance work, rental income, or investment dividends.

One of the most common types of 1099 forms is the 1099-MISC, which is used to report miscellaneous income amounting to $600 or more in a calendar year. It’s important to accurately report this income to the IRS to avoid penalties or fines. The 1099 form is typically provided by the payer, but if you haven’t received one or need additional copies, you can easily access a printable version online.

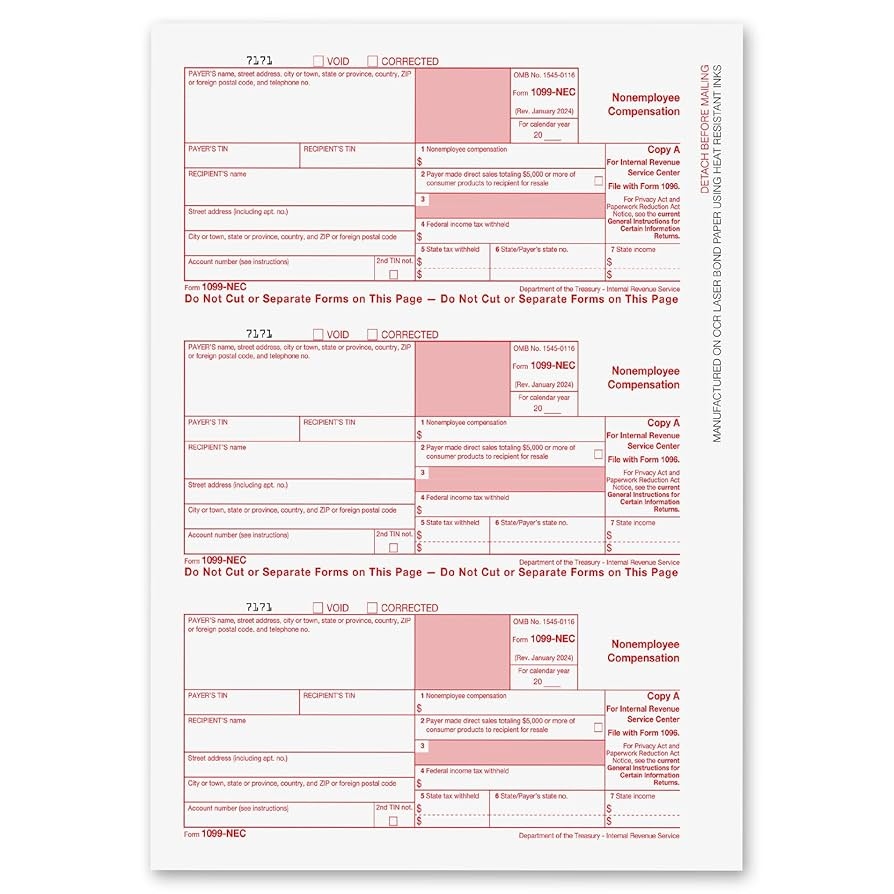

1099 Form Printable

When it comes to tax documents, convenience is key. That’s why having access to a printable 1099 form can be incredibly helpful for individuals who need to report miscellaneous income. Many websites offer downloadable and printable versions of the 1099 form, making it easy to fill out and submit to the IRS.

Before filling out the 1099 form, make sure you have all the necessary information, including your personal details, the payer’s information, and the amount of miscellaneous income you received. Double-checking this information is crucial to ensure accuracy and avoid any discrepancies that could trigger an audit.

Once you have completed the 1099 form, you can either mail it to the IRS or file it electronically, depending on your preference and the guidelines provided by the IRS. Be sure to keep a copy of the form for your records and submit it by the specified deadline to avoid any late filing penalties.

In conclusion, understanding the 1099 form and how to access a printable version can make tax season less stressful for individuals with miscellaneous income. By accurately reporting this income to the IRS, you can avoid potential issues and ensure compliance with tax regulations. So, be sure to familiarize yourself with the 1099 form and utilize the printable version when needed.